Investment tips to better manage your money

Successful investing involves making decisions that meet your unique needs today and your financial objectives for the future. Your personal circumstances will impact your choices every step of the way. Whether you are saving for retirement, a home, or your child’s education, you want a plan that will assist your money to grow. Below are some investing principles to follow:

Know yourself

We all have various investment objectives and different time frames for attaining them. Some are short-term, such as saving for a car or a vacation, while others are long-term, like retirement. Besides, every investor has a different comfort level with investment risk. Whereas risk appears like something to avoid, there can be an upside- higher risk might offer the chance for greater rewards over the long term. Getting a balance between reward and uncertainty that you are comfortable with- and that is appropriate for your investment time frame- is a significant first step to successful investing. To understand yourself better as an investor, consider your risk tolerance, investment objectives, investment knowledge, investment time horizons, approximate net worth, and gross annual income.

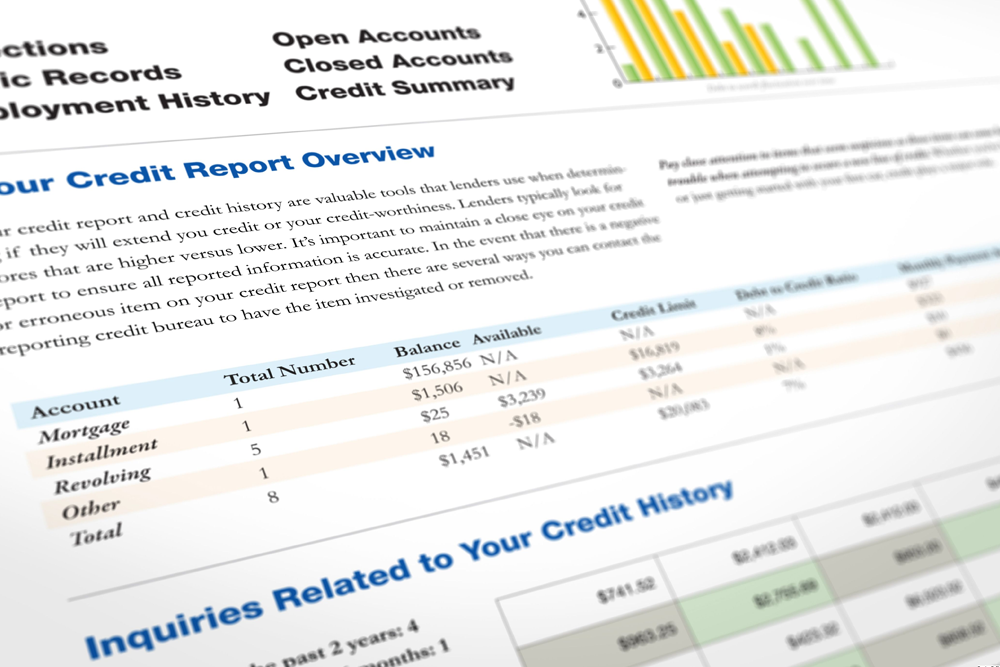

Deal with your debts

Before you start to save, analyze what it costs you to carry debts you already have, and consider how rapidly you may discharge those. Besides, high-interest credit cards can carry rates of twenty-percent or more, and student loans have interest rates over ten percent. Those rates eclipse the standard annual earning seven percent or so that the United States stock market has returned over time.

In case you are carrying a lot of high-interest debt, it is more sensible to pay off at least some of it prior to making investments. Whereas you cannot predict the exact return on most of your finances, you can be sure that retiring debt with a twenty percent interest rate one year early is as good as earning a twenty-percent return on your money.

Consider your retirement

A key objective of saving and investing, even at an early stage, should be the assistance to ensure that you have enough money after you stop working. One priority in your strategy should be to take full advantage of the inducements dangled by employers and governments to encourage retirement security. In case your organization offers a 401(k) retirement plan, do not overlook it. That is doubly the case in case your organization matches part or all of your contribution to the program.

For instance, in case you have an income of $50,000 and contribute six-percent of your income to your 401(k) plan, your employers may match that by contributing an extra $3,0000. A less generous employer may contribute up to only three-percent, adding $1, 500 to your $3,000 contribution. You will always want to invest enough to get the entire amount of your employer’s match.

401(k)s and some other retirement tools are also robust investments as a result of their favorable tax treatment. Many enable you to contribute with pretax dollars, which decreases your tax burden in the year you contribute. With others, such as IRAs and Roth 401(k)s, you contribute with after-tax income but withdraw the funds without tax, which can decrease your tax hit on the year of withdrawal. And remember, in case your money has grown for many years, there will be much more than you initially contributed so that those tax-free withdrawals will be worth it. In both cases, the earnings on what you invest accumulate tax-free within the account. Even though your employer does not offer any match on your 401(k) contributions, a strategy is still a good deal.

Invest your tax refund

In case you find it difficult to save money all through the year, consider saving part or the whole of your tax refund as a strategy, to begin with investing. It is one of the few moments in the year where you are likely to get a windfall that you were not already counting on.

Create a diversified portfolio

Diversifying your assets across a wide range of investments is an effective way to decrease risk and amplify potential returns over the long term. Holding a mixture of various types of investment will assist cushion your portfolio from downturns, as the value of some investments might go up while the value of others might go down.

Monitor your portfolio

You should assess your investment portfolio with a CIBC advisor, or on your own, at least once per year to make sure that it continues to meet your needs. Market conditions, life events (children, marriage, and retirement), and changing goals are cues to review your portfolio.

Align your investments with your time horizons

The kind of investments you select will be based on whether you are saving for long-term or short-term goals. For your long-term objectives, you might want to consider long-term, growth-oriented investments. Your short-term goals call for investment that is more conservative and more accessible. For instance, in case you are investing to save for down payment on a home, you will want quick and easy access to your funds.

What do you invest in?

Build broad diversification through a mix of low-cost mutual funds and ETFs, while keeping it fun by holding stocks with up to ten percent of your assets. The most significant factor in being a successful investor is not the stocks and funds you choose. Successful investing depends on the following:

- Select proper asset allocation: the overall mix stocks, bonds, and cash you hold in your portfolio.

- Sticking with an automatic investment strategy- this way, you avoid making emotionally, terribly-charged decisions- such as selling at the bottom of a market crash.

Mutual funds

A mutual fund is a kind of professionally managed investment that pools your funds with other investors. The fund’s directors then use the pooled money to purchase securities for the group. It is best to begin your investment in mutual funds or exchange-traded funds instead of individual bonds and stocks until you get your feet wet. These kinds of funds enable you to invest in a broad portfolio of stocks and bonds in one transaction instead of trading them all yourself.

They are not only safer investments (since they are diversified); however, it is often far less expensive to invest this way. You will either pay just one trading commission or nothing at all ( in the event you purchase a mutual fund from the fund company), as opposed to paying trading commissions to buy dozen or more different stocks. Even though mutual funds can be purchased via any brokerage account, you will save money on trade commissions by purchasing funds directly via a mutual fund company such as You Invest and E-Trade.

Bonds

Whether it is corporate, treasury, or municipal, bonds are a great way to leverage your investment against the success of other entities. Bonds are debt security that raises capital for others. They finance new organizations, local projects, and even the United States government. While no investment is risk-free, government bonds (T-Bonds) are just about as close as you can get. You might also want to contemplate investing in good bonds. Worthy bonds are $10 each and offer a fixed rate of return of five percent. Each bond has a three-month three-month term, and interest is paid weekly. Cash in the bond any-time you would like (even before maturity), and you will never pay the penalty. The money you invest in the worthy bond is utilized to fund American businesses and is very picky about which companies to lend to. They only invest in organizations whose liquid assets far exceed the amount of the loan, making the risk low for a terrific five percent return.

Robo-advisors

In case you are trying to really get started as a first-time investor, one option for you is to go the Robo-advisor route. The easiest way to understand Robo-advisors is that they are financial advisors that use algorithms to offer you with the very best advice about financial investments. Robo-advisors are very popular at this juncture since they make investing accessible for everyone. These easy-to-use apps are more affordable, more convenient, and they have lower investment minimums than standard financial advisors.

Besides, there is no investment broker, and the costs are lower as compared to traditional management firms. In case you are new to investing and can afford to begin putting money away for retirement, I recommend every day start investing with a Roth IRA. In case you already have a retirement account or require to invest money for another objective (such as purchasing a home or beginning a business), a standard brokerage account will do. Bear in mind that your capital gains- the money you earn when you sell a security for more than you paid for it- is taxable, as will be specific dividends you receive.