Different funding opportunities for your business

The U.S. Small Business Administration provides grants and loans. They aim to provide eligible small businesses and community-based organizations limited small businesses grants and loans to promote business entrepreneurship and business development, resulting in community development.

Table of Content:

- Grants that are available under the COVID19 Relief Programs.

- Grant programs for small businesses under the SBA.

- Loan programs under SBA for small businesses.

- Loan programs under the COVID Relief Programs.

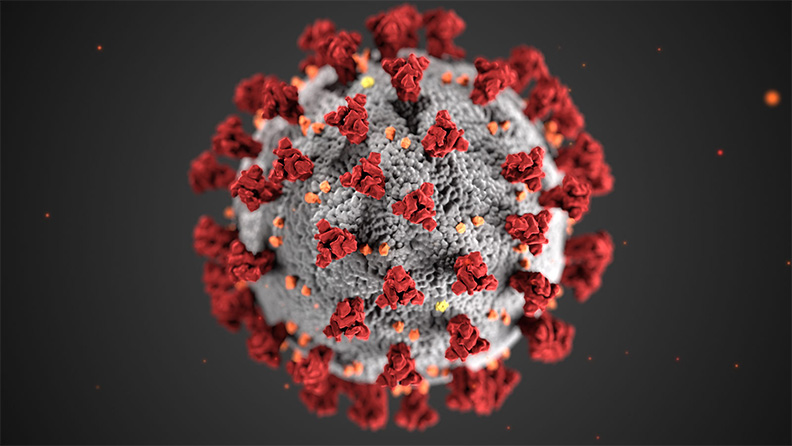

Grants that are available under the COVID19 Relief Programs

Shuttered Venue Operators Grant (SVOG)

Economic Aid established the above program. It aims to provide financial assistance to hard-hit small businesses, the venue acts, and nonprofits. SBA’s Office of Disaster Assistance will be administering over $16 million in government grants to shuttered venues under the SVOG program.

How to apply for the SVOG

The grant will prioritize small businesses that have been the most affected by the Coronavirus pandemic to provide financial assistance. As of August 20th, 2021, SVOG is no longer accepting new applicants. The official portal remains open to all active applicants and awardees. The grant applications are open here; https://www.svograntportal.sba.gov/.

The application processes under this SBA program follow this schedule:

| First Priority – will be awarded grants in the first 14 days. |

|

| Second Priority – will be awarded grants in the next 14 days. |

|

| Third Priority – will be awarded grants 28 days after the first and second priority phases. |

|

| Supplement funding – This will be available after all the priority phases are done. |

|

Grant programs for small businesses under the SBA

State Trade Expansion Program (STEP)

Thousands of small businesses have been helped by the STEP grant program since 2011 to get business financing and find customers in the international marketplace. The program provides financing for services provided by the federal government via federal agencies like the U.S. Department of Commerce. All interested small businesses apply online through the following link:https://www.sba.gov/document/support-state-trade-expansion-program-step-grant-application-instructions.

Small Business Innovation Research (SBIR) & Small Business Technology Transfer (STTR) Programs

If your small business is engaged in scientific research and development, it can be eligible for this grant opportunity. Both the SBIR and the STTR programs provide federal grants to encourage small businesses to participate in innovative scientific research. This research should help achieve development objectives, meet federal research, and have high commercialization potential if successful. Interested small business owners apply through https://www.sbir.gov/.

SBA’s Management and Technical Assistance

The Management and Technical Assistance Program is also called the 7(j) Program. Authorized by the Small Business Act, the program provides high-quality assistance to help small businesses compete for state, federal, local, or government contracting opportunities.

The program’s eligibility requirements are; businesses located in areas with high unemployment rates and low-income rates, are economically disadvantaged women or minority-owned small businesses, HUBZone small businesses, and 8(a) participants or owned by low-income individuals. If you meet the following qualifications, proceed to https://www.sba.gov/tools/local-assistance/districtoffices to apply.

Small Business Development Centers

The above program is a cooperative effort of the educational community, private sector, federal, state, and local government. It aims to enhance economic development by providing technical and management assistance. The program has special activities aimed at economic development such as venture capital formation, procurement assistance, and rural development.

Programs under SBA for small businesses loans

The U.S. Small Business Administration offers the following funding opportunities:

The SBA 7 (a) Loan Program

The above loan program is the primary lending program. This SBA loan is mandated to purchase supplies, help with business cash flow, equipment financing, working capital, and other operating expenses. This loan has strict requirements; it is not suitable for borrowers with a bad credit score or a startup small business.

Microloan Program

The Microloan program is primarily for nonprofits, business startups, and new or expanding small businesses. Borrowers are prohibited from using loan funds to pay existing debt or purchase any property/real estate. Lenders have varying loan requirements; generally, you will be expected to present documentation like; personal background or a business plan.

The SBA 504 Loan Program

The 504 loan is also called an Equipment loan or Real Estate loan. The Small Business Administration makes this loan available via lenders to small businesses with long-term and fixed interest rate financing for major assets.

Loan programs under the COVID19 Pandemic Business Relief Programs

The following are the programs under the COVID19 small business relief fund options provided by SBA. If you are a business owner who has been hit hard by the Covid Pandemic, you can finance your business through these means;

The Paycheck Protection Program

The Paycheck Protection Program (PPP loans) came to an end on May 31st of 2021. Eligible borrowers are now encouraged to apply for the PPP forgiveness loan program https://www.sba.gov/funding-programs/loans/covid-19-relief-options/paycheck-protection-program/ppp-loan-forgiveness.

The COVID 19 EIDL (Economic Injury Disaster Loan)

Small business owners (department of agriculture included) and nonprofit organizations are eligible for this loan.

Qualifications for an EIDL Disaster loan?

- Agricultural businesses with 500 or fewer employees

- Businesses engaged in food and fiber production.

- Small business owners.

The SBA Debt Relief

The SBA Debt Relief

The Debt Relief Program offers existing borrowers whose businesses have been severely impacted by COVID 19. This affects the SBA 7(a), SBA 540, and Microloans. Borrowers do not apply for this service; the SBA will automatically act.

The Restaurant Revitalization Fund

This fund helps eligible businesses, such as restaurants, keep their doors open. The program will provide restaurants with funding matching their pandemic-related loss. It is a no-interest loan. Applications are made through the POS (Point of Sale) Vendors or directly via SBA in the online application portal on the official website.