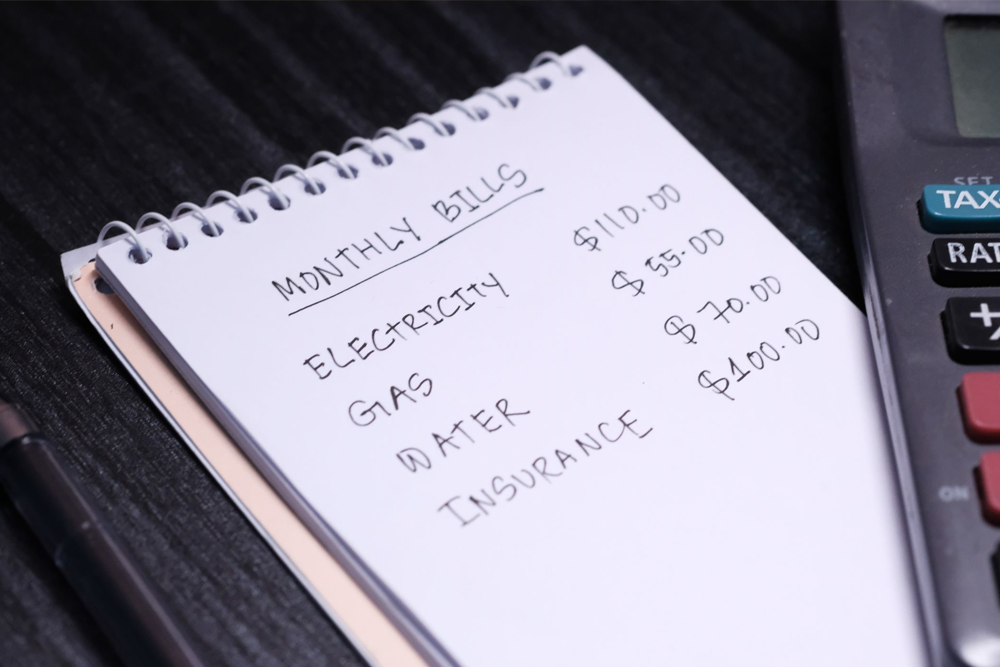

To make excessive use of the best credit card signup bonus offers, you need to have outstanding credit, and the ability to meet a card’s minimum spend requirement within the defined duration-often within three months of opening the account. And if you are going to be spending all that money anyhow on vacation presents, it can be a win-win situation. Cash-back cards have a tendency to have the lowest spending requirements with the best return rates, whereas travel rewards cards often offer larger bonuses after you attain higher spending requirements.

Make sure you consider your budget before you sign up for a credit card with a good bonus offer and only make excessive use of one if you can pay off your balance in full and on time. You do not want to pay big interest charges on your balance just because you were hoping to make some extra bonus points. The best part is: Various credit cards waive spending requirements altogether and reward you with a bonus following account approval or after you make your first purchase.

Various cards that offer bonuses and narrowed down to the best deals

Chase Sapphire Preferred card

Chase Sapphire Preferred card is an ideal option for those who are new to earning travel rewards. It allows you to earn valuable, transferable Chase Ultimate Rewards points with strong bonus sections, all at a reasonable annual fee.

When it comes to rewards, this travel credit card is offering 60,000 points once you use up $4,000 in the first three months. According to TPG’S valuations, this is worth $1,200. The Chase Sapphire Preferred earns five times on LYFT; two times points on other travel and dining; one time on everything else. Because dining and travel are both broad categories with Chase, this indicates you are earning rewards on a large number of purchases.

Typically, you will find points that are most valuable when transferred to one of Chase’s excellent airline and hotel partners, particularly for premium redemptions. On the other hand, points can be worth 1.25 cents each toward travel and activities booked via the Chase Ultimate Rewards travel portal, where you can access money-saving options for economy flights and budget travel.

On the downside, the $95 annual charge is not waived the first year like it is for some other mid-tier travel credit cards, and there are no luxury travel perks. Whereas the lack of luxury benefits as standard on cards with lower annual charges, it is something to consider for anyone who often travels enough to get a lot of value out of perks like travel credits or lounge access. However, you are actually getting the best value from your points when you retrieve them for travel, either via the Chase travel portal or by transferring them to a partner. If travel is not a priority, a cashback card might be more valuable to you.

Discover it® Cash Back

The Discover it® Cash Back offers one of the most generous and this enticing cash back rewards programs in the credit card field. With the Cashback Match, Discover it® Cash Back Will automatically match all the cash back you have earned at the end of your first year and open up your new Discover it® Cash Back credit card. That is right- there is no limit to the amount that they will match. And bonus- you do not even need to sign up for this. In simple words, if you convert $400 in cash back into $800, or $1000 to $2000, you will get five-percent cash back on rotating quarterly categories with a max spend of $1,500 each quarter.

In 2020, the five percent cash back quarterly bonus categories are:

- January to March: Walgreens, Grocery stores, and CVS (excludes Target and Walmart).

- April to June: Wholesale Clubs, Lyft, Uber, Gas stations

- July to September: PayPal and Restaurants

- October to December: Target.com, Walmart.com, and Amazon.com

You must activate each quarter to take advantage of the five percent cash back categories. Besides, you will earn unlimited one percent cash back on all other purchases automatically.

Wells Fargo Propel American Express® card

Wells Fargo Propel American Express® card is the best sign-up bonus credit card for rewards. Weighing in at 20k bonus points for spending $1,000 in the first three months (a $200 cash redemption value), the Propel offers one of the largest sign-up bonuses for a no annual charge credit card. The grand advantage of this credit card is that its outsized bonus amount is accompanied by a bold three times rewards rate on categories that will benefit a large swath of consumers: choosing streaming services, rideshares, gas stations, dining, and travel. On the downside, the streaming services that earn three times points are limited to a select few, albeit very famous one: Sirius XM Radio, Pandora, Apple Music, Spotify Premium, Hulu, and Netflix.

Capital One® Venture® Rewards Credit Card

Capital One® Venture® Rewards Credit Card is the best sign-up bonus credit card for miles. With a 50,000 mile sign-up bonus, the Venture Rewards has a lot going for it for its spend of $3,000 within the first three months. With seventeen travel partners, you can get a strong return, like with JetBlue’s TrueBlue, which converts at a rate of 2:1:5. That indicates 50,000 in Capital One miles comes to 37,500 TrueBlue points and based on TPG’s TrueBlue valuation of 1.2 cents, that comes to $450.

Capital One Venture® Rewards Credit Card main pro is that it offers strong rewards of two times miles on all purchases, together with the credit of up to $100 for TSA pre-Check or Global Entry. However, you need to watch out because while the sign-up bonus is comparable to that of the Chase Sapphire Preferred, the Capital One® Venture® Rewards Credit Card does not enjoy the CSP’s twenty-five percent bonus when booking travel via Chase Ultimate Rewards.

Capital One® Spark® Cash for Business

Capital One® Spark® Cash for Business is one of the best credit card sign-up bonuses for cash rewards. With this card, you will earn two percent across each purchase, despite the spending category. The credit card’s low $95 annual fee is easily offset by the potential rewards, making this an easy selection for small businesses looking to make cashback across a wide variety of expenses.

Capital One® Spark® Cash for Business earns $500 once you spend $4,500 on purchases within the first three months, which is not a very high spending threshold for most business owners to hit. You are earning unlimited two percent back on all spending, which makes this a versatile credit card for both larger businesses and freelancers.

Freelancers or other kinds of business owners who have a low monthly budget and a wide range of expenses, this credit card is a great alternative to aid them to earn rewards without paying a high annual fee. In fact, the yearly fee is waived the first year. For larger corporates, this credit card acts as an excellent cash back for purchases that do not earn rewards with any other card. Rewards do not expire as far as your account is open, and employee cards are free.

On the downside, Capital One® Spark® Cash for Business is a straight-forward cash back card, which indicates you are not getting luxury perks or access to transfer partners. Whereas that may appeal to some, those looking to redeem rewards for travel will be better off with other business credit cards.

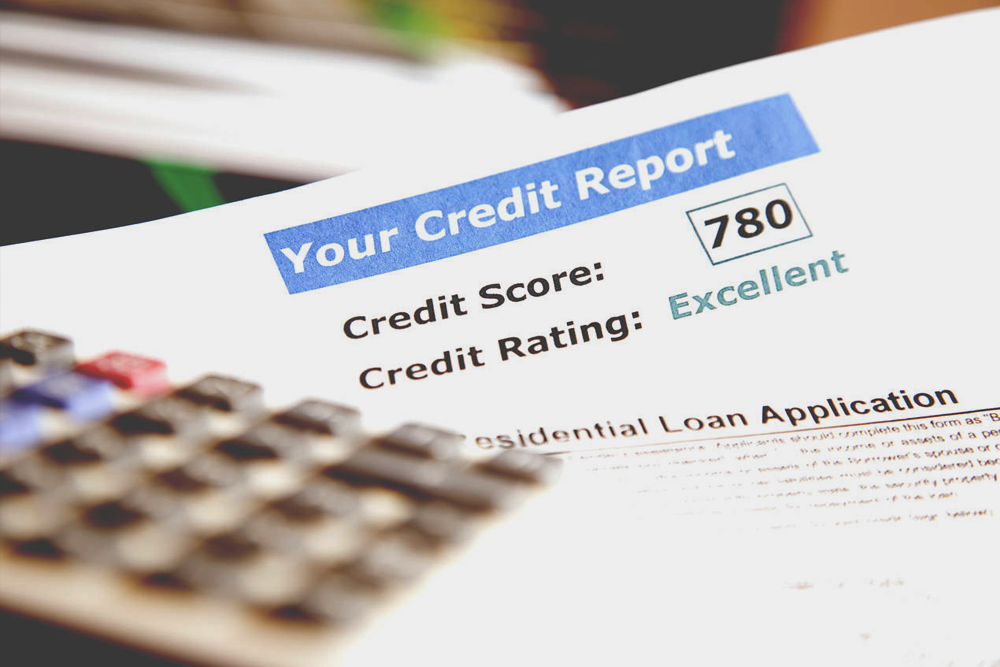

In conclusion, the best sign-up bonus credit cards are really the cream of the crop of the whole credit card market. The right credit cards offer the biggest bonuses, benefits, and terms that are both manageable and reasonable. Simply put, if your credit scores enable you to access this category, you should definitely consider applying for one of these credit cards. But make sure you read the terms, comprehend what you are signing up for, and calculate the worth of the offer before you jump in.