A step-by-step guide to setting up a construction equipment financing company

A construction equipment financing business helps business owners in the construction industry obtain working capital quickly to buy or lease the items they need for their businesses. These businesses can seamlessly manage their cash flow, as this financing will enable them to spread their payments over a longer period. Construction equipment financing can finance the following tools. Note the list is not exhaustive.

Vehicles; dump trucks, bulldozers, excavators, and forklifts: Computer Equipment; tablets, mobile computing, and cad software: General Machine Equipment; compressors, CNC machinery, drill presses, conveyors, concrete mixers and pumps, and milling machinery: Tools; jackhammers, backhoes, welders and pneumatic pipe benders, and welders: Other equipment needs such as worksite security systems.

Starting a construction equipment financing business requires a thorough understanding of your target customer’s needs and a comprehensive product line, and a solid business plan that describes how you will make your business successful. Moreover, any new finance company must comply with strict federal and state regulations and meet initial funding requirements. Here are detailed steps of how to start a construction equipment financing business.

Step 1: Confirm the business opportunity

A new construction financing company must be able to attract clients and generate a profit. As a consequence, it is essential to research the expected market space where the company will compete. How big is the market? Who presently serves potential customers? Are prices (interest rates) stable? Is the market limited to a particular geographic area? How do existing businesses attract and serve their clients? How do competing businesses differ in their approach to promoting and service features?

- Recognize your target market or the particular clients you intend to serve. Explain their needs and how you plan to meet them.

- Outline your area of specialization. For instance, if your market research indicates a growing number of small startup construction companies needing equipment loans, describe how the financial services and products you provide are strong enough to gain a significant share of that market.

- Consider the businesses already in the competitive space. Are they dominated by a single company or are they similar in size? Similar market shares might indicate a slow-growing market or the companies’ inability to distinguish themselves from their competitors.

Note that identifying your target market will require you to recognize key demographics that are currently underserved and how you intend to draw these clients away from your competitors. You should list who these clients are and how your financial products will appeal to them. Include any advantages you have over competitors.

Step 2: Identify business requirements

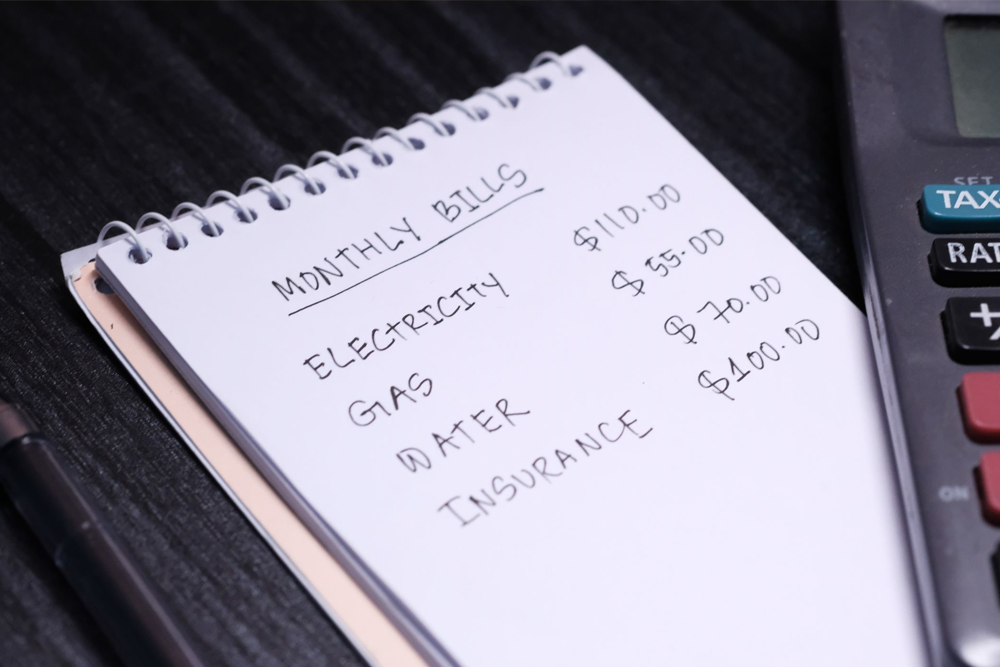

Identify the likely fixed costs of operating a construction equipment financing business – equipment, office space, utilities, wages, and salaries? What business processes are vital for day-to-day operations – loan officers, marketing, underwriters, accountants, and clerks? Will potential customers visit a physical office or communicate online, or both? Will you require a financial partner such as a bank?

Step 3: Crunch the numbers

How much money is required to open the business? What is the expected revenue per customer or transaction? Before risking your own and other people’s money, you have to ensure that profitability is possible and reasonable, if not likely. Establish a financial projection (proformas) for the first three years of operation to understand how your construction equipment financing business is likely to fare in the real world. The projections should incorporate month to month Income Statements for the first year, and quarterly statements thereafter, and projected Balance Sheets and Cash Flow Statements.

Step 4: Make a self-assessment

Start by identifying your skills. Before beginning your new business and, possibly, a new career, it is vital to objectively assess your personality and skills to determine what steps you have to take to successfully begin and manage a construction equipment financing company. Do you have any special training in the finance specialty? Do you understand finance, leasing, and accounting? Are you a leader who inspires others? Do you have any special skills specifically suited to the construction equipment financing industry? Do you work well with people?

Now consider your experience. Have you worked in the equipment financing industry or construction industry before? Are you professionally and monetarily successful in your current position? Do you understand accounting, marketing, legal matters, or banking?

While at it, do not forget to determine your financial capacity. Do you have enough capital to open the equipment financing company you envision? Do you own assets that can fund your living expenses during a startup phase? Will your friends or family contribute to the financing of your business? Can you access other financial sources such as personal loans, financial sponsors, venture capital, and investment funds?

Step 5: Creating a business plan

A business plan serves a number of functions. It is a road map for building your business in the future, a guide to making sure you remain focused on your goals, and a comprehensive description of your business for potential investors and lenders. Start writing your business plan by incorporating all of the required areas and leaving room to fill them in. The steps in this section should serve as your sections, starting with the business description.

- Write a business description: This is a summary of the organization and the goals of your business.

- Describe the organization and management of your business: Clarify who owns the business. Specify the qualifications of your management team and create an organizational chart. A comprehensive, well-established organizational structure can help a financial institution be more successful.

- Describe your product line: Outline the types of financial products and loans you offer. Emphasize the benefits your products provide to your target customers. Also, specify the need your product fills in the market.

- Explain how your company is financed: Determine how much money you require to start your construction equipment financing company. Indicate how much equity you own. State what percentage other investors own in the business. Indicate how you plan to finance your business with leverage (loans), where these loans are coming from, and how the loans will be utilized in the business.

- Document your sales management and marketing strategies: Your marketing strategy should indicate how you intend to attract and communicate with customers and lenders.

- Include financial statements in your business plan: Assessing the pro forma financial statements you designed during your business planning, make sure that your projections are reasonable and conservative.

Step 6: Consider forming (LLC) Limited Liability Company

A Limited Liability Company is the same as a corporation in that it protects its owners from personal liability for actions or debts incurred by the business. Nonetheless, they have the tax advantages of a partnership or sole proprietorship. A corporation typically files taxes separately from the shareholders.

Step 7: Name and register your company

Select a name that represents your business and is unique enough to obtain a URL or website address. When selecting a business name, check with the U.S. Patent and Trademark Office to ensure you are not infringing on any trademarks. You should also check with your state to see if the business name is already in use by another corporation.

Step 8:Obtain the required operational permits and licenses

Financial institutions obtain these from the state in which they operate. Check with your State Business License Office to identify the specific permit and license you need. Typically, each state has different requirements for licensing financial institutions. You will have to specify exactly what type of financial institution you are opening. You will then furnish the requisite documents and pay any fees.

Step 9: Protect your company from risk and liabilities with indemnity insurance

Indemnity insurance secures you and your employees should someone sue you. Equipment financial institutions like yours should buy a specific kind of indemnity insurance known as Errors and Omissions (E&O) insurance. This secures the construction equipment financing company from claims made by customers for inadequate or negligent work. Government regulatory bodies usually require it. Note that staying in compliance with all regulatory requirements is still your responsibility.

Step 10: Setting up the company

This is the last section. Generally, here is what you need to do to set up your construction, equipment financing company:

- Obtain financing. You will need to finance your business according to your business plan, using a combination of debt and equity financing. Initial startup costs will be utilized for meeting reserve qualifications and the rental or building of office spaces. From there, much of the business’s operating capital will be lent out to customers.

- Choose your business location: A construction equipment financing company should make a positive impression on clients. Customers looking for equipment financing will want to do business in a space that projects a trustworthy and sound image. Consider the reputation of the neighborhood or a particular building and how it will appear to clients. Also, consider how clients will reach you and the proximity of your competitors.

- Hire and retain staff: Write effective job descriptions, so applicants and employees understand their role in the business and your expectations.

- Pay your taxes. First, get an Employee Identification Number from the IRS. This is also called your Federal Tax Identification Number. Determine your state and federal tax obligations.

- Market your new construction equipment financing company: Target your marketing and promotion efforts towards your chosen niche of customers. Marketing includes advertising and networking, but there are also other ways of letting potential customers know you have set up shop.