15 Habits of Highly Wealthy Traders

15 Habits of Highly Wealthy Traders

Online stock trading is the act of purchasing and selling a financial instrument within the same day or even multiple times over a day. Making excessive use of small price moves can be a lucrative game- if it is played well. However, it can be a dangerous game for beginners or anyone who does not adhere to a well-thought strategy.

Not all brokers are ideal for a high volume of trades made by day traders, nonetheless. However, some brokers are designed with the day trader in mind.

General day trading tips, and then move on to trading strategies and how to limit losses.

Understand the difference between trading and investing

Both investing and trading involve the markets; however, they are drastically different. In investing, you plunk money into a broad range of funds and leave them there long term. Trading is purchasing something (commodities, currency, foreign, gold, stock), with the belief that its value will increase in the very near future, at which point you will sell it.

When you invest, are inclined to diversifying- that is the best for passive investing. The idea is as the year’s pass, some investments will grow, whereas others will not. Trading is done in the very short term.

Set aside funds

Identify how much money you are willing to risk on each trade. Most successful day traders risk less than 1 to 2 percent of their account per trade. If you have a $40,000 trading account and are willing to risk 0.5 percent of your capital on every trade, your maximum loss per trade is $200 (0.5 percent*$40,000).

Put aside a surplus amount of funds you can trade with, and you are prepared to lose. Note, it might or might not happen.

Set aside time, too

Online stock trading requires your time. That is why it is called day trading. You will need to give up most of your day. Do not consider it if you have limited time to spare. The procedure needs a trader to trace the markets and spot opportunities, which can arise during trading hours. Moving faster is critical.

Identify your niche

Because specialization is vital to successfully trading, you need to choose the assets you will trade with care. Options include but not limited to: foreign currency, gold, commodities, bonds, and stocks.

Purchasing and selling stocks on the New York Stock Exchange is possibly the best-known option- it is also where the famous online marketplaces often allow you to trade-but it is not the simplest. Generally, trading foreign currencies is much easier since they are less volatile.

However, you first need to figure out what you think you have enthusiasm and expertise about. To really become an expert trader, you are going to need to understand the inner workings of whatever market you are quite literally hedging your bets on.

Create your hypothesis

Every move you make on the stock market should be like you think you are purchasing it since you feel it is too cheap, or the price will go up for some reason. And then you will sell it when it reaches X price.

Purchasing Whole Foods since you like it as an organization might or might not work as a strategy. The main thing is why you are doing it and why you think it will accumulate income. That is your hypothesis.

Generally, winning in online stock trading is all about anticipating what may happen next. To be able to strike with precision, you have to think critically about all of the possible variables and how they can impact the price of a stock between when you purchase it and when you sell it.

Start small

As a starter, center on a maximum of one to two stocks during a session. Tracing and identifying chances is easier with just a few stocks. It has become increasingly common to trade fictional shares so that you can specify particular, smaller dollar amounts you wish to invest.

This indicates if Apple shares are trading at $250 and you only need to purchase $50 worth, most brokers will now allow you to buy one-fifth of a share.

Practice on a paper

It is not very glamorous, but the best way to get started with online stock trading is with zero real dollars. Choose a stock, identify your hypothesis for the stock, note it down, and then wait. As the market moves, you will see whether you were right or not. And be honest with yourself.

Know your limitations

Today, computers do the vast majority of trades. And when it comes down to it, you are no match for a robot. Computers trade applying algorithms rather than gut instinct, and decisions are instantaneous. There has been debate about how to make online stock trading fairer because computers closer to the NYSE can trade faster than those farther away.

Information travels faster over fiber-optic networks; however, distance matters. The fractions of milliseconds it takes for information to travel across town add up when a huge investment firm is making thousands of trades a day.

You are never going to be as emotionally detached or as fast as a computer. So stock trading will possibly never be as lucrative for you as it is for Corporate Wall Street firms. If you are thinking of this as your main channel for generating retirement income, you need to think again.

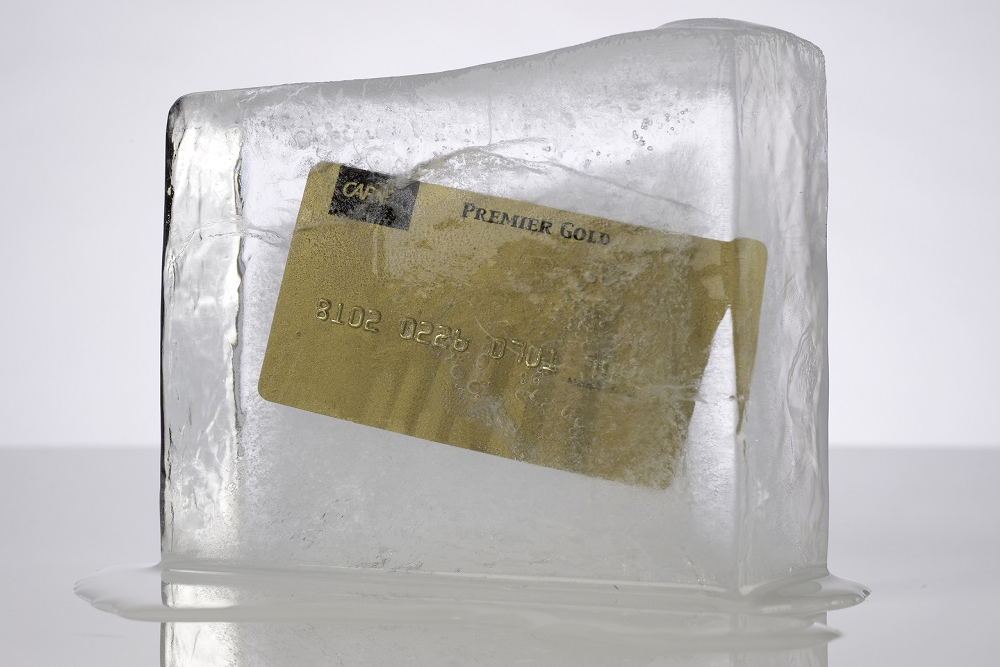

Choose your website

For the most part, competition has generally pushed trading fees so low that the cost of trade is almost nothing market-wide.

Yet, since your account information will be synced with either your credit card or bank account, you want to ensure you are using a site with a good reputation. Most people look for more data, more research, and more news. A survey of self-directed investors carried out in 2015 by J.D Power identified what investors wanted most was to access guidance.

Avoid penny stocks

You are possibly looking for deals and low prices; however, stay away from penny stocks. These stocks are frequently illiquid, and the possibilities of hitting the jackpot are usually bleak.

Most stocks trading under $5 a share become de-listed from major stock exchanges and are only tradable over the counter. Not unless you see a real chance and have done your research, just avoid these.

Stick to the plan

Successful stock traders have to move quickly; however, they do not have to think fast. Since they have developed a trading plan in advance, together with the discipline to stick to that strategy. It is vital to follow your formula carefully instead of trying to chase profits. Do not allow your emotions to get the best of you and abandon your strategy. There is a mantra among online stock traders. Plan your trade and trade your plan.

Put your money elsewhere

Experts recommend that the money you allocate for stock trading should be small. Maybe this is what you should do instead of going to Vegas.

The rest of the invested money needs to be in well-diversified, long term investments, and possibly ones offering compound interest. Remember that at the end of the year, this is not going to be a W-2 you can live off of.

Be realistic about profits

A plan does not have to win all the time to be profitable. Most traders only win 50-60 percent of their trades. Nonetheless, they might make more on their winners than they lose on their losers. Ensure the risk on every trade is limited to a particular percentage of the account, and that entry and exit methods are clearly defined and noted down.

Stay cool

There are times when the stock markets test your patience. As an online stock trader, you need to learn to keep hope, greed, and fear at bay. Decisions should be controlled by logic and not your emotions.

Time your trades

Most orders from traders and investors start to execute as soon as the markets open in the morning, which contributes to price volatility. A seasoned player might be able to identify trends and choose appropriately to make profits. However, it might be better for beginners to read the market without making any moves for the first fifteen to twenty minutes.

The middle hours are often less volatile, and then movement starts to pick up again toward the closing bell. Even though rush hours provide opportunities, it is safer for beginners to avoid them at first.

Understand the psychology of losing

Winning feels great; however, losing hurts. And it even hurts at a rate unequal to the joy we feel when we win.

This is known as loss aversion, a renowned tenet of behavioral psychology and economics. Loss aversion is the reason people trade when the market slips. We tend to take the loss to avoid more loss. And sometimes that is the right choice, and sometimes it is not.

To avoid being whipsawed (continually reacting to a share’s most current price change), you have to have a firm strategy in place and the discipline to stick to it even when things are hard to take.

15 Habits of Highly Wealthy Traders

15 Habits of Highly Wealthy Traders