Changes in working capital are very common in the business world. Such a change is best explained as the modification to net working capital between accounting cycles. Net working capital is equal to the difference between existing liabilities and existing assets. Every business manager intends to minimize upward alterations to working capital to make a positive effect on the bottom line. The question is, what factors cause these changes to working capital? Let’s explain some of the top causes.

Changes in the working capital: How to calculate?

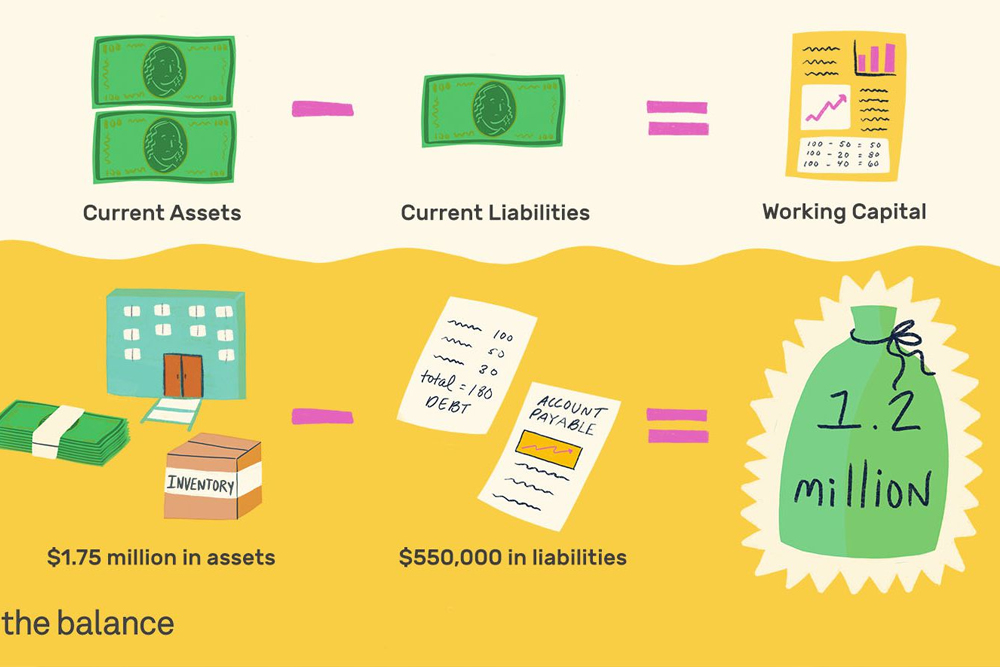

The formula for calculating net working capital changes is – working capital of the current year minus working capital of the previous year. Another formula is, change in current assets of two periods deduct change in current liabilities of those two seasons. Now, take a look at the steps to calculate changes in working capital: First, you need to calculate the total amount of current assets for the previous and current year using your balance sheet figures. Next, calculate the total amount of existing liabilities for the previous and current year using your balance sheet figures. Third, use the above two figures to get the net working capital for the previous and current year. Lastly, use the formula outlined above to calculate the changes in your working capital.

EXAMPLE

To understand the calculation better, let us consider an example. Company B has a current liability of $10,000 and existing assets of $20,000 for 2020. The current liability and current assets for 2019 were $ 8,000 and $15,000, respectively. In 2019, the net working capital was $7,000 ($15,000 deduct $8,000). In 2020, the net working capital is $10,000 ($20,000 deduct $10,000). Now, the change in net working capital is $3,000 (10,000 deduct $7,000).

In this situation, the change is positive, indicating the current working capital is higher than the last year. It indicates Company B would have to find ways to finance this increase. It might sell shares, sell assets, or take on more debt to meet the increase in the working capital.

- A company will witness no change in the working capital if the current assets and current liabilities increase by the same amount.

- If the change is positive, it could indicate that the current assets in the current duration have raised more than the corresponding change in the current liabilities.

- Conversely, if the change is negative, it would indicate that the current liabilities have increased more than the current assets’ corresponding change.

Explanation

Working capital is a good gauge of liquidity. A business with positive working capital, i.e., having higher current assets than current liabilities, would be able to fund its short-term expenses and would keep on operating comfortably. Nonetheless, if the variation between the existing assets and existing liabilities is too much, it could indicate the underutilization of resources. Likewise, negative working capital (current liabilities are more than current assets) is not always bad. It could mean the business is growing.

On the same line, net working capital change offers us an idea of a business’s cash position. If the change is positive, it would indicate there is more cash outflow in the form of more current assets. And Ii the difference in the net working capital is negative, it would indicate that current liabilities have increased more, such as an increase in bills payables. So, this would mean a cash inflow.

What causes a change in working capital?

Here are several actions that can cause changes in working capital:

Changes to the accounts payable payment period

The typical company goes back and forth with suppliers before settling on a certain payment period. This length of time has a direct impact on the business’s cash on hand. Still, it is also possible for suppliers to decrease or increase prices to offset payment period terms.

Consider the growth rate of a company.

A business that grows slowly will not need to change its working capital monthly significantly. Alternatively, a business that experiences rapid growth will need considerable working capital changes from one month to the next. Such a modification is necessary as the business needs to spend money on extra inventory and accounts receivable. This spending ties up cash.

Credit policy modifications

If a company tightens up its credit, the total number of accounts receivable will reduce. This policy change generates cash. However, credit policy modification can also create fewer net sales. Loosening up a credit policy has the exact opposite effects.

Alterations to purchasing practices

A purchasing department’s decision to reduce unit costs by purchasing in large volumes will trigger a boost to inventory investment. This increased investment is a means of utilizing cash that could otherwise be spent in different sectors. Buying in smaller quantities produces the opposite impact.

Hedging Techniques

A business’s hedging strategy can create offsetting cash. As a result, the odds of unexpected alterations to working capital reduce. Still, such a hedge will generate transactional costs that qualify as a use of cash. These costs must be accommodated and considered in an appropriate manner.

Acquiring long-term debt.

When a business takes out a long-term loan, the money borrowed goes into a current asset, often a cash account. The business also acquires a noncurrent liability, the debt itself. Your transaction involves a current asset and a noncurrent liability and is thus a working capital source.

Collections policy alterations

If a company adopts a more aggressive collections stance, it will probably spike payments and lower the aggregate number of accounts receivable. This is a fast way to get cash. A company that adopts a more conservative collections policy will have the opposite impacts.

Changes to inventory planning

A company that opts to boost its inventory levels to heighten its order fulfillment rate will experience greater inventory investment. Greater inventory investment requires more money that could be used for other purposes. Decreasing inventory creates the opposite effect.

Importance of working capital changes

The following points reflect the importance of changes in the working capital:

- It is a relevant part of the statement of cash flows and shows the operating cash flow.

- Changes in the working capital is an essential input for valuing a business.

- It also suggests if the existing assets are rising or reducing in proportion to the current liabilities or not.

- An increase in the working capital would mean a better liquidity position. It could also indicate that the company is effectively exploiting its existing resources.

- It helps to answer a significant question: Does the company need more cash as it grows or generates more money?

What does not affect working capital?

Transactions that involve only current accounts have no net impact on the amount of working capital. That kind of transaction impacts the elements of working capital, of course, however, not the result of deducting current liabilities from current assets.

It is also true for noncurrent accounts. A transaction that does not involve a current account does not alter the amount of working capital. An example is a depreciation. Suppose your company owns a truck that it purchased for $20,000. You record it on your books as a fixed asset worth $20,000. However, the truck loses value over time — that is, it depreciates — and you now keep that amount of loss periodically. The amount of loss you report is determined by which one of several methods for determining depreciation you and your accountant choose to use.

That method might inform you to record $300 in depreciation for the first month your business owned the truck. You record $300 as a debit to an expense account, maybe named Depreciation, and also as a credit to a fixed asset account, possibly named Truck: Accumulated Depreciation. Neither account is a current asset account; thus, the transaction has no impact on working capital.

Note: Even though depreciation is recorded in expense and fixed asset accounts, and therefore does not affect working capital, it still needs to be accounted for when you are calculating working capital.

How does a change in working capital affect cash flow?

Change in working capital alone will not decrease or increase cash flow; it has to be seen in your business context. However, when working capital is insufficient, the business’s ability to operate optimally is lowered. When more than required, working capital is available, and if the fund can attract a cost, it also causes loss and, hence, reduced cash flow. Usually, working capital is money needed to smoothly cover your operations after availing your suppliers’ credit and advances, if any, from your clients. Generally, monitoring alterations in working capital is one of the key responsibilities of the chief financial officer, who can change company practices to essential to understand changes in working capital from the viewpoint of cash flow forecasting so that a company does not experience an unexpected demand for cash.