As with personal credit, building business credit can lead to lower insurance premiums or assist you in getting approved for low-rate interest rates business loans. It can also help you get approved for a lease or business line of credit and secure better terms from vendors. After starting a business, you can find that you require to sign a personal guarantee when applying for a business loan or opening a business credit card. This guarantee typically means that you will be personally liable for the debt if the business is not able to pay it back- a case that can put your personal assets at risk. After you establish business credit, you can qualify for a business loan or credit without a personal guarantee. Building business credit starts with establishing your business and applying for a business credit card. Now that we have evaluated the potential benefits of business credit let us look at ways to start building and managing yours today.

How to build business credit?

Step 1: Check your business and personal credit

Don’t you know if your business has a balance? No need to worry; there are many ways to check your business’s credit reports. Unlike with personal credit history, there is no legal requirement for the credit bureaus to give you free access to the reports of your business credit. All three major credit reporting bureaus will provide you with a full copy of your business credit report for a fee. You can get free access to your Dun & Bradstreet and your Experian report via Nav, a company that assists business owners in creating and managing their credit. It is also essential to review and learn about building your personal credit. Most business owners find that having both good business and personal credit is vital. Some creditors may check the owner’s personal credit, particularly when a business is still young. Others might check business credit, and some lenders check both.

Step 2: Establish your business credit

If you did not find anything when you went to check your business’s credit report, it is possible that your business has not established any credit yet. This may happen if you use a personal credit card for your business’s expenses. Like your payments will only wind up on your personal credit reports. Even though some business-scoring models can generate a business credit score based on your business and personal credit report and other business financial information, others depend solely on information associated with your business. To establish business credit, you might first require to take the following steps:

- Register with Dun and Bradstreet to get a D-U-N-S number: This is a nine-digit number used to recognize each physical location of your business. It is free for all businesses needed to register with the federal government for grants and contracts.

- Incorporate your business or from an LLC (limited liability company. This makes sure your personal and business identities will be separate.

- Get a dedicated business phone line: You will also want to ensure it is listed under your legal business name.

- Open a business bank account: Ensure you use your legal business name

- Get a federal employer identification number: This is a free service provided by the IRS, and it will also act to identify you as a business entity.

Business credit bureaus can utilize your D-U-N-S or EIN to identify your business’s activities and payments when reported, and business credit scoring systems can use the data to generate reports and scores. Business credit scores can also take into account public records like legal filings, liens, and your business’s industry and size. However, a history of on-time or early payments can go a long way in assisting in creating a strong financial track record.

Step 3: Apply for a business credit card

To develop your business credit profile, you will need vendors and accounts that report your payments to the credit bureaus. A business credit card can be a good start. Business credit cards might also offer benefits and rewards programs that are more helpful to business owners than the features or rewards on a personal credit card. Below are some business credit cards to consider if you are interested in applying for one:

- Brex Card for Startups: Fast-growing startups may be interested in this credit card with lots of cash on hand.

- Capital One® Spark® Cash for Business: Ideal for business owners that plan to spend a ton on their credit card, this cashback rewards option may be just the ticket.

- Ink Business Preferred® Credit Card: If you are constantly on the go for business travel, you will want to check out this credit card.

- Capital One® Spark® Classic for Business: This credit card could be ideal for those with average credit or limited credit history.

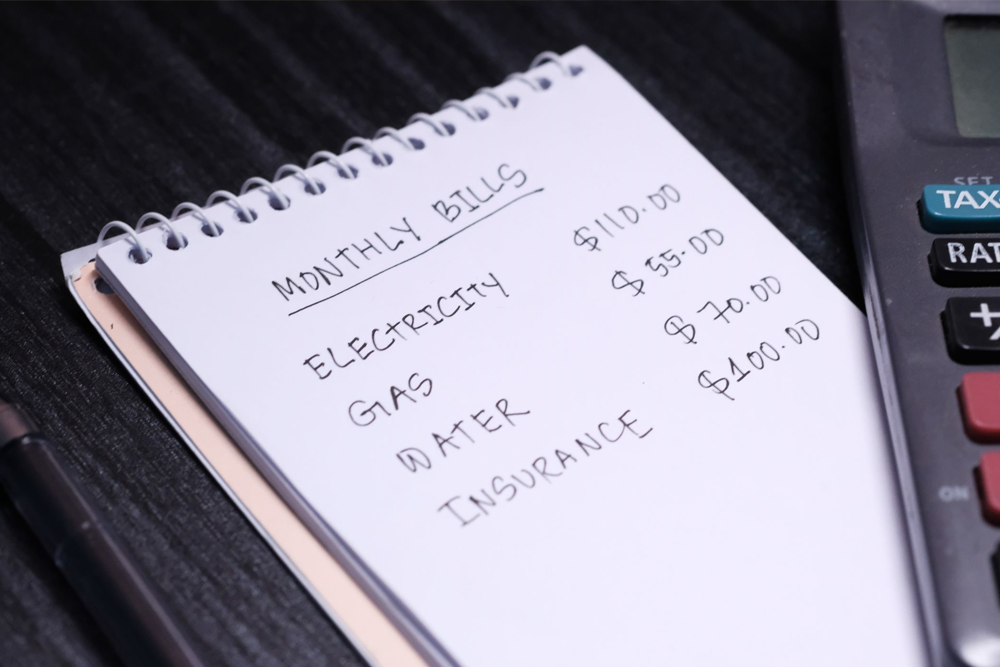

Step 4: Pay your bills on time

This is possibly the number one principle in any credit situation. Paying your bills on time shows that you are reliable and can effectively manage and pay off your debt. A late payment history, particularly severely delinquent payments, will bring down your business credit rating and negatively affect your business credit profit.

Step 5: Put your business on the map

Just because you are up and running a business, it does not necessarily mean you have yourself on the map. You can not effectively establish credit until you have developed your business. Get a business phone number and have it listed in the directory. Every credible business should have one. You will also want to open a business bank account in your official legal business name, and often use it to pay your bills. You are required to open a business credit file to establish business credit.

Step 6: Monitor your business credit

Twenty-five small business owners have reported significant mistakes in their credit reports. Diligently monitoring your business credit history can assist you to spot any issue or information that is not accurate. If you do find an error, make sure you file a dispute with the reporting agency. Sign up for Nav to get an alert when your business credit profile has been designed with Experian or Dun and Bradstreet.

Step 7: Establish trade lines

Whereas a lot of information can wind up your business credit reports, trade lines can be specifically significant. Business trade lines are lines of credit developed between a business and a vendor, like an account with an office supply company where the company enables the business to pay the account balance several days or weeks after getting the inventory. Vendors may report this account to any credit reporting agency; however, they are not required to do so. Based on the kind of credit report, a trade line that is reported might include information like your available credit, the amount owed, the terms of the account, current activity, and when you pay, comparative to your due date.

You can have a business credit report without trade lines; however, it might be challenging to build business credit without any. This is because your number of trades lines and your payment history might be factored in your business credit file.

Here is what you have to watch out:

- Not every vendor will report your payment activity. So even though you always pay your vendors early or on time, you might not be building your business credit.

- Be careful about opening an account with an annual fee, as you do not want to have to pay just to keep an account open, and you might be able to find more cost-effective options.

- If you are trying to boost your business credit, you may want to begin opening business trade accounts or lines, like business credit cards, with organizations who report to the business credit reporting bureaus.

It can take time to build your business’s credit, which is why it is essential to start early. Whether or not you foresee requiring a loan or line of credit, developing your business credit now will give you a safety net- and potential savings- in the future.