Student credit cards are crafted for college students who have no or limited credit. These credit cards are a great way to build credit history and learn about financial responsibility. Often student credit cards offer low credit limits, and most do not charge annual fees. If you are looking for some of the best student credit cards and also want to learn how to use them responsibly, you are in the right place.

Lists of Student Credit Cards

It might seem like you have too many to choose from, but this article will help you do your homework. Check out the credit cards below and find the right one today.

Discover it® Student Cash Back: Best Student credit card for everyday spending

Discover it® Student Cash back boosted quarterly rewards might comprise categories such as groceries and gas, thus making it a snap for daily spending. With the good grades program, you can make a 420 statement credit every school year that your GPA is 3.0 or inflated (for up to the next five years), offering you a little more cash in your pocket. A major concern regarding this card is that the rotating categories might not be useful for a consumer just starting since it takes a fair amount of organization to use- you have to sign up every quarter and trace which categories apply that quarter. Besides, there is no sign-up bonus, so you have to wait until the end of your first year to access your boosted rewards.

Discover it® Student chrome: the best student credit card for cash back

This is a perfect credit card for a student on the go since you earn two percent cash back both at restaurants and gas stations for up to $1,000 a quarter (then one percent). Discover it® Student chrome provides many of the same functionalities and perks to Discover it® Student Cash Back: no credit history needed, no APR changes for late payments, no annual fee, and good grades rewards. However, even if no credit history is required with this credit card, making it simpler to get than other credit cards, you will want to ensure you are reasonably organized so that you pay in full every month and on time to build your credit.

Deserve® Edu Mastercard for Students: The best student credit card for Amazon.com

This credit card offers some benefits that are hard to come by-for example, a once $59 credit for your Amazon Prime Student membership, a distinct functionality perfect for the students who purchase textbooks on Amazon. This is an excellent advantage for online student shoppers. In fact, according to TSYS, credit cards are consumers’ favorite payment methods for online shopping.

Typically, the Deserve® Edu Mastercard for Students is another great option to aid your credit history. Similar to other top picks, it comes with no yearly fee, assisting keep money in your pockets for ramen purchases and tuition. Other perks of this card include price protection, ID theft protection, extended warranty, travel assistance, and no foreign transaction fees. On the downside, this credit card one percent on all purchases can be easily beat, and it lacks sign-up bonus, so if you are on the hunt for rewards, you might want to look elsewhere.

Journey® Student Rewards from Capital One®: The top student card for student travel

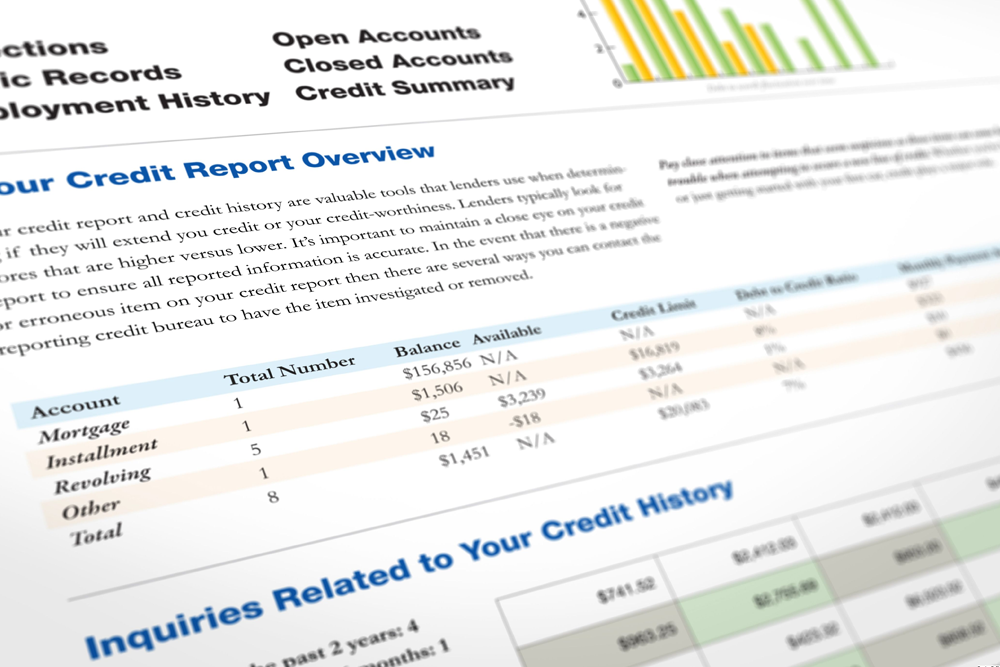

Journey® Student Rewards from Capital One® not only rewards students with 1.25% back if you pay on time- a nice incentive for young cardholders to build good financial habits- but also comes with no foreign transaction fee and no annual fee, making it a good selection for a semester abroad. Journey® Student Rewards from Capital One® provides access to a credit line increase after paying on time for your first five monthly bills. And paying on time is made simpler by the fact that you are allowed to select your own monthly due date. However, a significant concern about Journey® Student Rewards from Capital One is that it only requires fair credit, you will need to have an independent income if you are under twenty-one due to the Credit CARD Act of 2009.

Citi Rewards+℠ Student Card: The best student credit card for small purchases

Citi Rewards+℠ Student Card offers bonus rewards at supermarkets and gas stations, and its rounding-up feature indicates you can earn outsize rewards on small purchases. This makes it a good selection for students with a lot of little expenses. With this card, you can earn 2,500 bonus points after you spend $500 in purchases with your credit card within three months of account opening, redeemable for a $25 gift card at thankyou.com. It also has zero percent Intro APR on purchases for seven months. After that, the variable APR will be 14.49 percent to 24.49 percent, depending on your creditworthiness. However, it comes with foreign transaction fees.

Capital One® Secured Mastercard: Best student secured credit card

Capital One® Secured Mastercard needs a security deposit, as do all secured credit cards. But whereas most credit cards need you to put down a deposit equal to your credit line, this one enables some qualifying applicants to get a $200 credit line with a deposit of $99 or $49. Further, if you make your first payments on time, you may get access to a higher credit line with no extra deposit. This credit card has no foreign transaction fee or annual fee. However, it has a high APR.

Bank of America® Travel Rewards for Students: Ideal for travel

The Bank of America Travel Rewards for students is our pick for the best student travel card as a result of the high earning rate on its rewards program that you can then redeem for hotels, flights, rental cars, vacation packages or baggage fees. It also has a long introductory APR on purchases and has no annual fee, which adds to the credit card’s strong rating. Besides, the lack of foreign-transaction charges makes this an ideal card for students to travel outside the United States.

This card has a decent (1.5 points for every dollar spent) travel-rewards earnings, and no tiers to manage. You will also enjoy paying off purchases for one year with no interest. On the downside, the rewards are not transferable, and no zero percent APR balance transfer offer. Also, relatively high spending ($1,000 in the first ninety days of account opening) is required for a 25,000 point introductory one-time bonus.

Bank of America® Cash Rewards for Students: Ideal for cash back

Bank of America® Cash Rewards for Students has a strong cash back rewards program, a compelling one-time bonus ( a comparative rarity for a college student card), and a zero percent introductory APR on purchases and balance transfers- all with no annual charge. The card’s cash back rewards program is competitive with the best non-student cash back cards. As an added benefit, free FICO scores are offered, which students can use to trace how they are doing at improving their credit, which will potentially enable them to qualify for a broader range of credit cards in the future.

This credit card has a three percent cash back on the category of your choice and two percent on groceries up to a quarterly mixed spending cap. Moreover, it comes with a fifteen-month zero percent APR offer on purchases and balance transfers from the period of account opening. It also comes with overdraft protection and rewards bonuses for banking clients. On the cons, the foreign-transaction fee is less than ideal for those studying abroad. Also, the highest rewards earnings are capped, and the relatively high spending ($1,000 in the first ninety days of account opening) needed for a $200 introductory one-time bonus.