Not unless you work in the insurance industry, you might only have a vague sense of what accident insurance is- and no, we do not mean car insurance. In simple words, accident insurance pays a benefit to you and your family in the event that an accident causes your death or gets injured in an accident. When gauging your overall insurance wants and options, it is smart to consider accident insurance.

For one thing, accident insurance is highly affordable. For another, it is typically easier to obtain than other kinds of insurance, even though it helps fill gaps in those primary coverages. However, not everyone needs accident insurance all of the time. This article will help you know when to put it to use.

What is accident insurance?

Accident insurance, sometimes known as personal accident insurance or supplemental accident insurance, is a kind of additional insurance product that covers particular injuries, such as burns, concussions, dislocations, fractures, and lacerations. Certain policies might also have additional coverage, paying out of services such as physical therapy appointments, ambulance rides, and certain kinds of medical testing.

Accident insurance is sometimes tied to critical illness insurance and is often provided through employers and traditional health insurance coverage. Whereas individual plans vary, some of the advertised diverge from primary coverage in very attractive ways, including the following:

- Network-free coverage: enabling you to choose where you receive care without agonizing over whether or not the office works with your policy.

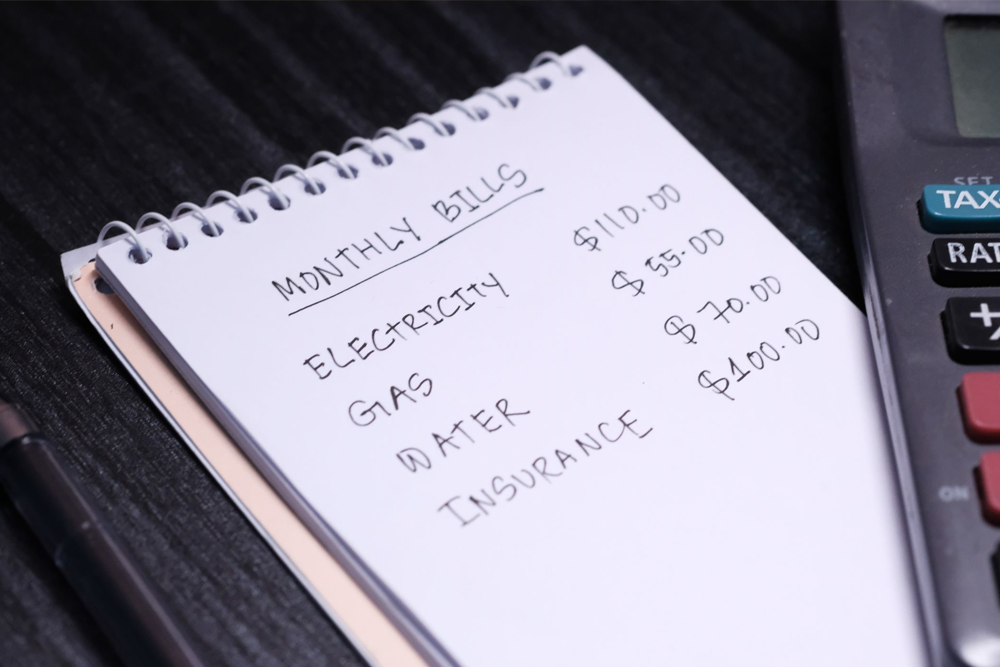

- Benefits paid directly to you (contrary to your care providers), which indicates you can also use them to cover expenses associated with the accident, such as medical insurance deductibles and household bills.

- Guaranteed acceptance: indicating your coverage is not dependent on your existing health markers, such as primary health insurance or critical illness coverage is.

- Additional benefits, like dismemberment and death coverage or supplemental benefits for loading expenses to the accident

Together with these enticing terms, the price of accident insurance is also very affordable in most situations. It is not unheard to see plans accessible for as little as $6 monthly. Of course, despite how small the premiums might be, there is a waste if you never really needed them, or if the insurance provider finds ways to avoid paying out benefits in the event you do get hurt.

Typically, one of the reasons additional insurance products, such as accident insurance, are so cheap is because the benefits and your eligibility to receive them- are pretty narrow.

Overview of what accident insurance covers

Accident insurance is an umbrella term that comprises several kinds of different coverage. Sometimes, you will find all in one policy; sometimes, they are provided on a standalone basis.

- (AD&D) Accidental Death and Dismemberment -AD&D pays a lump sum benefit to your beneficiaries if you are killed as a result of an accident and pays a smaller sum if you lose an eye or a limp. The benefit is paid together with any life insurance you may have.

- Accident Medical Benefits: This kind of coverage basically pays lump-sum benefits for various medical expenses incurred from an accident. For instance, if you break a leg, your plan might pay $500 for the ER, $400 for the ambulance, $1,000 for surgery and $1, 500 for your hospital stay- all paid in addition to health insurance.

- Accident Disability Benefits: If you are injured in an accident and cannot work- or can only perform some of your duties- this coverage will pay a percentage of your monthly income. If you are injured on the job and collect workers’ compensation benefits, these benefits may be decreased by your workers’ comp benefits based on your policy.

Moreover, there are specialized kinds of accident coverage for employees, incorporating business travel accidents for salespeople and executives, occupational accident protection for professional drivers, and voluntary group accident coverage that employers can make accessible to everyone.

Is accident insurance worth it?

Sadly, you will not get a direct answer to this question. This applies to almost all kinds of insurance, for that matter. Whenever you buy insurance, you are wagering that you will need the payout someday, while the insurance company is wagering that you will not.

Accident insurance gives some consumers peace of mind, especially if they lead a very active lifestyle. Besides, medical deductibles can be sky-high and major accidents can be costly even with traditional coverage. Together with the care itself, you might also have to factor in wages lost by missing work.

Generally, we are familiar with the term accidents happen; however, most of us think they happen to other people, not us. Nonetheless, statistics do not lie- we are all at greater risk than we think. For instance:

- Accidents are among the leading three causes of death globally, together with cancer, and heart disease, following the S. National Safety Council.

- Auto accidents are the most common fatal accident. The chances of dying in a car accident are one in 144, following the National Safety Council data.

- Injuries are the main cause of death in Americans under age forty-five following the Centers for Disease Control data.

- Other main causes of accidental death in the United States, including firearms, falls, drawings, pedestrians, and fires, following the National Safety Council data.

Whereas these are not pleasant to think about, they are a good reminder that accidents are part of life.

Having said that, you should not depend on supplemental plans exclusively. Following Policygenius, payouts for injuries such as severe burns on a third or more of your body might be covered for as little as $5,000 based on your policy.

What is more, accident insurance pays out its benefits on a preset schedule. In contrast, other kinds of insurance, such as disability insurance, might pay out benefits every month for up to a decade. Besides, your policy might not pay for your specific kind of injury if it is not one of the listed options. And there are many ways of being hurt.

5 times when you need accident insurance

If you have various health, life, and disability insurance, you possibly do not need additional accident insurance right now. Nonetheless, in the following situations, accident insurance can offer valuable financial security that is otherwise missing:

When you do not have (or have enough) life insurance

If health issues make it difficult for you to be eligible for life insurance, or cannot afford the premiums, Accidental Death and Dismemberment is a great solution. Not only is the policy economic, but also, most policies require no or minimal medical underwriting. Particularly it makes sense if you are young since accidents are the leading cause of death under age 45.

When your health insurance plan has gaps

If your health insurance policy has a high deductible, high coinsurance percentages or limited provider network, accident medical insurance- which pays out flat benefit amounts for a particular medical service- can decrease your out-of expenses in addition to health insurance.

When you do not have adequate disability income protection

Maybe you work part-time, you are self-employed, or your employer does not provide disability insurance. With accident disability benefits, you will still have dependable income in the event you are injured and unable to work.

When you drive extensively

Car crashes are the most kind of fatal accident, so if your job involves you being on the road often- aw with a truck driver, salesperson, delivery person, or service technician- you can benefit from accident insurance. Identify what protection your employer offers, and contemplate supplementing it if it does not seem like enough.

When you are engaged in high-risk work or play

Clearly., some lines of work, such as law enforcement and construction, are more hazardous than others. The same can be said for various pursuits or hobbies, like motor-cycle riding or scuba diving. If your lifestyle puts you at higher-than-average risk, you may want to invest in accident insurance, mainly if you have a family depending on you.

What are the alternatives to accident insurance?

If accident insurance is not worth it in your case, which insurance plans should you invest in?

Disability insurance

Disability can be a more substantial and holistic kind of coverage than accident insurance is, paying out up to sixty-percent of your monthly income, and doing so at regular intervals instead of all at once. Disability insurance might also cover maladies caused by illnesses, which accident insurance typically does not.

Nonetheless, disability insurance policies do not have the limitations and exceptions. One of the biggest is that you possibly will not be covered if your disability does not keep you out of work. There is also an elimination period to contend with, which indicates you might have to wait for a month (or even twelve months in some situation) after diagnosis or injury to start getting benefits.

Life insurance

In some situations, it is less yourself you are concerned about than your loved ones- especially in a severe accident which might lead to your death. And in those situations, an accident insurance policy is not going to cover it; you are possibly going to need to enroll in life insurance instead.

Better health insurance

This is one hard, as our health insurance options can be restricted based on where we work, how much we make, and other factors. But if possible, you can get a plan with better coverage- even though it means higher premiums- than might be a more effective option than endlessly tacking on these small, additional plans. If you decide that accident insurance makes sense for you, do your research and see what coverages are accessible from insurance providers that you know and trust.