Simple Steps To Help You Figure Out How Much Home You Can Afford

Your house will possibly be your biggest purchase, so identifying how much you can afford is one of the first significant steps in the home buying process. The good news is developing a smart home budget is easy and not too time-consuming. While it can be enticing to start browsing the listings immediately, the first strategy in calculating how much home you can manage is to consider the following:

- Your take-home per month

- The terms and size of the loan you will take out.

- The hidden costs of home ownership

- The size of your down payment

How much money do you take home?

The first step of business when making a budget is to determine how much of your salary is accessible to you. Typically, employers quote the amount of money they pay out (your gross pay) instead of the amount you take home (your net pay). There are various deductions taken from your paychecks for insurance, taxes, and retirement contributions. When thinking about what you can afford for a new home, you should always consider your net pay, since that is the amount of money you will have at the end of each month.

What is the real cost of your home?

Purchasing a home is a different experience, unlike anything else you have ever bought before. That is because the cost you see at the top of the listing will not be your final pay. Here is where things get complicated for first-time home buyers. Although the home you want has a certain value on paper, due to added costs, and the abiding interest on the loan you will borrow to purchase it, you will inevitably end up paying much more money for the house over time. Typically, depending on the duration of that mortgage, you can pay almost double the price you bought the home for. While that can be frustrating, it has a great effect on some of the choices you have to make upfront, and it all starts with your financing.

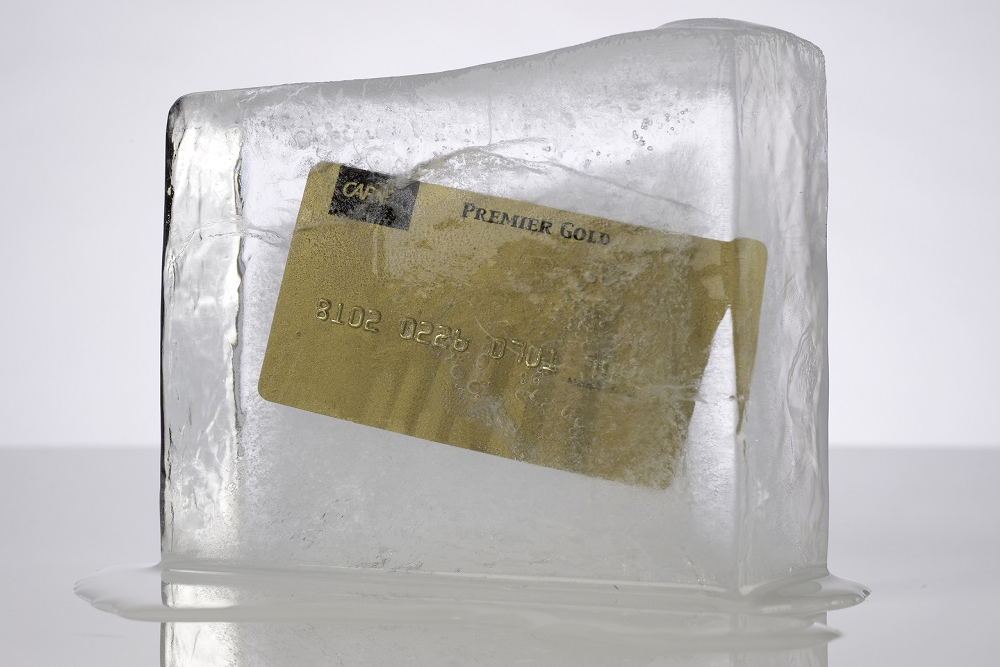

Line of credit or your mortgage

Not unless you have savings for years- or maybe you have currently robbed a bank- possibilities are you will not pay for your house in cash. Most of the home buyers take out loans to pay for the bulk of their purchase. There is nothing like free money. A new home is a notable investment, and it indicates any loan you take out, for it is an outstanding commitment as well. When it comes to debt of this size, three factors should take a central position in your decision procedure:

What is actually in your monthly payment?

Your monthly payment comprises the total amount you will owe each month for the period of the loan, based on the interest rate, term, and principal.

- Term: Basically, the term of a home loan is the period it will take you to pay back both the interest and principal. One reason purchasing a new home is such a commitment is that the standard term of a United States mortgage is thirty years. Based on your financial situation, though, there are alternatives available to make this shorter. A fifteen-year term, if you can afford the higher monthly payment- will gradually reduce the actual price of your home.

- Principal: Typically, this is the total amount that the creditor will offer to you. For a home loan, it is equal to the total value of the home and deducts your down payment.

- Interest rate: Each loan comes with interest. Interest is the amount above and beyond the principal that you have paid back to the creditor. It is essential to note that this interest is compound interest, which indicates that interest is calculated monthly based on the total amount owed.

Not unless your down payment is more than twenty percent of the value of the house, this payment will also incorporate private mortgage insurance, which is a fee charged by a creditor to insure them against default. It is this monthly payment number more than any other thing that typically dictates how much house you can afford. Specialists recommend you do not spend more than twenty-five percent of your take-home pay on your housing. Bear in mind that while the twenty-five percent recommendation is strong, it will not necessarily be a recommendation shared by your creditor.

The importance of your down payment

Even though it is rare to buy a home in cash, the amount of money you have on hand greatly impacts the selection of houses you can afford. Typically, the size of the down payment you can make on your home can transform not only the price range of houses you are looking for but also the cost of the loan. The more funds you have to put down, the less the total principal of your loan will be. Bearing that in mind, according to most experts, you should pay no less than ten percent of the price of your home upfront. Ten percent is not ideal, though. Those people who are looking to decrease their payments should pay twenty percent. If you can afford to put down twenty percent of the value of your house, you will not have to make payments for private mortgage insurance, which can substantially reduce your monthly payments.

The difference between fixed and adjustable rates

Even with the essential considerations out of the way, there are still various mortgage options accessible, with different repayment lengths and interest rates. Below is what to look for in adjustable and fixed-rate loans.

- Adjustable-rate mortgage: If you opt for an adjustable-rate mortgage, then once a set period with a fixed rate, your interest rate can be modified if the market does. There are a few occasions in which this is a better option than a fixed-rate loan.

- Fixed-rate mortgage: With a fixed-rate loan, your interest rate is locked in. If it begins at 4.5 percent, it will always be 4.5 percent. For home buyers, this indicates that if you can get a fixed-rate mortgage when rates are low, you will pay less overall. This is the top option in most situations.

The hidden cost of home ownership

When you purchase a house, you are not just buying a property; you are investing. As with all investments, there is a considerable amount of money to upkeep that you require only to keep your house in good working order. There are renovations and repairs; however, those are often unexpected and can be covered by an emergency fund. But there are also major expected costs linked with purchasing and owning a home that must be factored into your base house budget.

- Property tax: Every jurisdiction has its property tax rate, and this is frequently added to your monthly loan payment. When you are browsing for a new home, you will typically get an annual tax rate added to the listing. Note that the number is just an estimate and will be updated by your municipality so frequently based on the housing market.

- Home insurance: You should never make the mistake of not having a homeowner’s insurance. You are required to have a policy on most mortgages legally. But if you look around to get an acceptable policy, this should not add more than $100 to your monthly payment. If any disaster strikes, it might be the only thing that assists you to rebuild.

- Closing costs: Some of the most overlooked expenses of owning a house are the expenses and fees that come with the actual purchase of the property. Because they are not included in the sale price, they can get a lot of first-time home buyers off guard. In some situations, they might even limit the home you can afford. That is because, similar to a down payment, they frequently require payment in cash, and will cost between two percent and five percent of the price of the home. What they are composed of is a lengthy list that incorporates inspection costs, lawyers’ fees, and taxes inspection expenses, and other necessities that are unavoidable when purchasing real estate. Bear in mind that the home buyer does not typically pay any of the realtor’s fees.

Fortunately, you do not have to do the calculations alone. There are various reliable online calculators, which can approximate all the information discussed above for you.