How Do Startup Companies Finance?

Allowing your finance back office to slow you down can only slow you down if you’re a company aiming to go viral on a hyper-growth trajectory. When a new business is in the early stages of development (early-stage startups), it is common to start with spreadsheets and manual financial processes. The emphasis is on product creation and revenue model development. It’s never too early to get your money in order. When the product or offering enters the market and starts to grow, the company acquires extra funds and progressively formalizes its finance operations. By default, small accounting software packages are appealing options, and the journey to the finance back-office begins. You have two options: hire accounting service providers or hire a small workforce.

Table of content:

- What Is Hypergrowth?

- How Can You Achieve Startup Hypergrowth?

- How do startup companies finance?

What Is Hypergrowth?

Consider the following scenario. You got your “Eureka!” moment and made the decision to create a digital product or service. You crunched the statistics, devised a project budget, pitched your concept to investors, and received funds to build a prototype. You and two developers were the original members of your sales team; over time, you added more programmers, QAs, managers (business leaders), and even a product owner. Cash is flowing freely now (cash flow), and sales are skyrocketing. As a result, your CAGR (compound annual growth rate) increases respectively, with no signs of slowing down.

The World Economic Forum defines hyper – growth as a stage of startup expansion in which a business maintains an average annual growth rate of at least 40% for more than a year. This isn’t something that happens by chance; it’s the result of a long-term, purposeful effort guided by a complete growth strategy that includes corporate transformation and restructuring.

How Can You Achieve Startup Hypergrowth?

There is no specific recipe for success when it comes to generating a hypergrowth business. Many firms take years to build traction and reach the inflection point. Even if there are many factors that go towards exponential (and sustained) startup development, we can find some characteristics among all massively successful businesses. The first is scalability, which is achieved by a repeatable business model that can be easily replicated in multiple places. The second component is technology, which allows companies in cities like New York to capitalize on previously untapped prospects. Finally, there’s talent.

Scalability

Hypergrowth in the startup world refers to a company’s eagerness and ability to scale. On the other hand, Premature scaling is one of the major causes of startup failure.

Many incumbent organizations succumb to the “too fast, too soon” approach due to a lack of a consistent startup growth strategy that targets sustainable development of all essential startup dimensions. They increase their workforce inexorably, overpay on product innovation, and pour money into marketing without first ensuring the correct product/market fit.

Therefore, how can a startup determine when it’s time to scale?

- Before making any steps, any startup that wants to scale must achieve continuous profitability. More significantly, it needs to know where all of its money comes from.

- Second, a firm that wants to develop must have a clear company ethos that all employees understand, agree with, and follow.

- It’s also critical to have a defined expansion strategy in place, which considers corporate goals, success metrics, remote team communication standards, and personnel onboarding and training procedures.

- Before growing further, a clear vision of technology and connectivity setup as well as expenditures is required.

- Finally, startup founders must have faith in their core staff before scaling. As the company expands, it’ll need a dependable group of long-term employees to set the quality bar for remote or contract workers.

Technology

Hypergrowth is strongly linked to technological advancements. Hypergrowth startups are using innovation to stimulate growth in ways other than just disrupting their product or service. They also employ technological advances to reduce costs, keep teams linked, shorten time to market, and respond quickly to changes.

- Cloud computing is extremely popular among high-growth companies. They choose cloud systems to self-hosted and shared data centers to save money upfront, save security costs, and get the speed, agility, and scalability they need to move quickly.

- On the backend, startups are most likely to use PHP, Node.js, Ruby on Rails, and Python, which run on flexible frameworks and provide comprehensive library support to allow for the rapid development of contemporary, scalable web and mobile applications.

- When it comes to client-facing apps, JavaScript is the language of choice for growing businesses, with React and AngularJS being the most popular libraries. Their scalability, ease of use, and moderate learning curve ideally complement growth-oriented startups’ agility and speed requirements.

- Hypergrowth companies rely heavily on data. They use big data to get valuable insights better to match their offers to client demand (valuations). Forward-thinking entrepreneurs are using AI technologies to improve customer service, tailor marketing campaigns, streamline HR operations, and optimize other elements of their e-commerce businesses such as amazon for increased revenue, profit margins, and agility.

Team

It’s impossible to avoid expanding your crew if you seek hypergrowth. To achieve your goals, you’ll need employees with a growth attitude, quick to pick up new skills, and willing to roll with the punches when new duties and positions occur.

As a high-growth company grows, it can supplement core personnel with a trained on-demand workforce, which is a cost-effective and flexible way to address changing recruitment needs. Organizations require distinct competencies at different stages of growth, depending on their existing size and plan. They can obtain long-term, on-demand access to skills that are unavailable on the local job market by collaborating with a trustworthy talent resourcing partner.

Developing businesses such as uber can dynamically alter these resources in line with their current demand by collaborating with a broad team of professionals (finance team). It is possible to fill practically any function through such a collaboration, from software consultants, graphic designers, and copywriters, through HR and marketing managers, product owners, business analysts, and accountants. They also avoid the significant overhead associated with managing in-house personnel.

How Do Startup Companies Finance?

Starting a business can be quite costly. One of the first significant financial decisions most business owners make is how to fund their fintech company/startup. How one chooses to fund their company could have an impact on how they structure and run it.

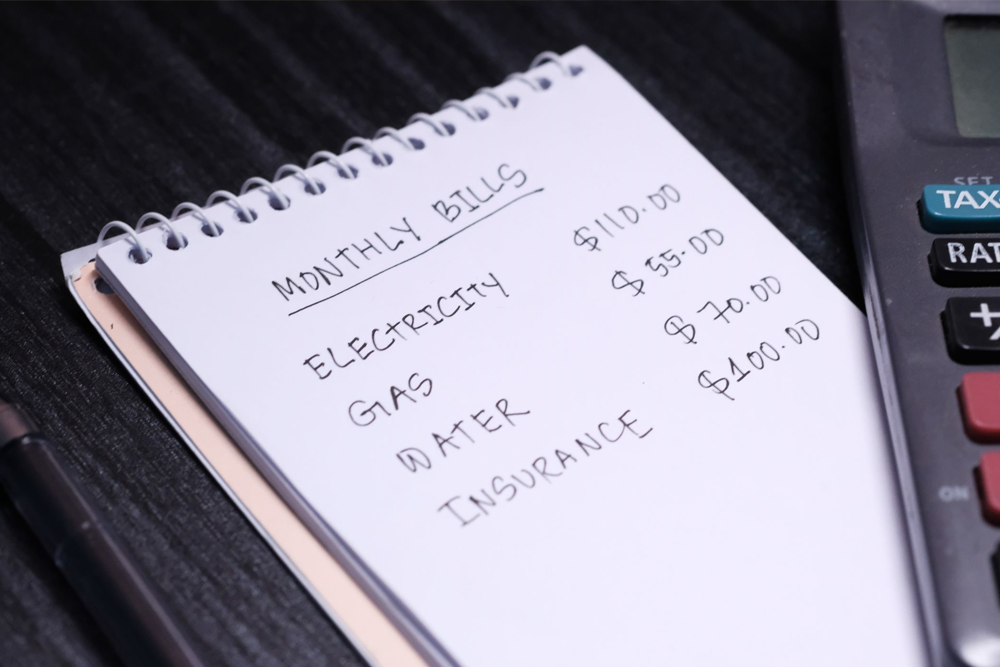

Determine how much funding you’ll need

There is no one-size-fits-all financial solution. Every firm has unique requirements. Your personal financial status and business vision will determine your company’s financial future. Once you’ve determined how much beginning capital you’ll require, the next step is to determine how you’ll obtain it.

Fund your business yourself with self-funding

Self-funding, often known as bootstrapping, allows you to use your financial resources to finance your firm. Self-funding can be borrowing money from family and friends, putting money in savings accounts, or even taking money out of your 401(k).

One keeps entire control over the business when they self-fund, but they also take on all of the risk management. Make sure you don’t spend more than you can afford, especially if you’re taking money out of your retirement account early. You could incur costly costs or penalties, as well as jeopardize your ability to retire on time, so consult your plan’s administrator and a personal financial advisor first.

Get venture capital from investors

Venture capital investments are a type of money that investors might provide to help you launch your firm. Normally, venture capital is offered in exchange for a share of ownership and an active involvement in the company.

In a number of ways, venture capital varies from traditional finance. Typically, venture capital lenders:

- Concentrate on high-growth businesses.

- Instead of debt, it invests capital in exchange for equity (equity financing).

- Takes more risks in exchange for a bigger possible gain.

- Traditional financing has a short-term investment horizon.

Almost all venture capitalists will desire a seat on the board of directors at the very least. As a result, one should be prepared to give up some control and ownership of your business in exchange for funding.

How To Get Venture Capital Funding

There is no guarantee that one will receive venture capital. The procedure typically follows a set of fundamental steps.

| Step 1: Find an investor | Single investors, also known as “angel investors,” or venture capital firms are good places to start. Be sure that you carry out sufficient research to assess whether the investor is credible and has expertise working with startups. |

| Step 2: Share your business plan | The investor will go through your business plan to ensure that it fulfills its investment criteria. The majority of investment funds are focused on a specific sector, geographic region, or stage of business development. |

| Step 3: Go through due diligence review | The management team, market, products and services, corporate governance documents, and financial statements will all be scrutinized by investors (forecasting). |

| Step 4: Settle on the terms and conditions | If they want to invest, the next step is to reach an agreement on a term sheet, which lays out the terms and conditions under which the fund will make a decision. |

| Step 5: Investment | After making an investment, a venture fund (venture debt financing) becomes actively involved in the company. You can get the investment once you’ve agreed on a term sheet! Normally, venture capital funds are distributed in “rounds.” More rounds of financing are made available as the company achieves milestones, with pricing modifications as the company executes its plan. |

Use crowdfunding to fund your business

Crowdfunding: It is a method of pooling funds for an organization from a big group of people known as crowd funders. Since they don’t receive a piece of the company’s ownership and don’t expect a financial return on their investment, crowd funders aren’t technically investors.

Instead, crowd funders anticipate receiving a “present” from your company as a thank you for their support. The present is frequently the product you want to sell or other special privileges, such as seeing the business owner or having their name in the credits. As a result, crowdfunding is a popular choice for anyone looking to create artistic works (such as a documentary) or tangible goods (like a high-tech cooler).

Crowdfunding is also popular since it carries a low risk for entrepreneurs. Not only does one get to keep complete control of their company, but they are usually not obligated to reimburse their crowd funders if their plan fails. Since each crowdfunding platform is unique, make sure to read the fine print and fully comprehend your financial and legal responsibilities.

Get a small business loan

Consider a small business loan if you want to keep complete control of your company but lack the necessary capital to get started. You should have a company strategy, expense sheet, and financial projections for the next five years to increase your probability of acquiring a business loan. These tools will help you figure out how much money you’ll need and show the bank that you’re making a good decision by taking out a loan.

Reach out to banks and credit card unions to request a personal loan once you have your materials ready. To acquire the best conditions for your personal loan, you’ll want to compare offers.

Use Lender Match to identify lenders who offer SBA-guaranteed loans

The US Small Business Administration (SBA) can agree to guarantee your loan if a bank believes your business is too hazardous to lend to. As a result, the bank takes on less risk and is more ready to lend to your company. If you’re having problems acquiring a standard business loan, SBA-guaranteed loans can be a good option.

SBA Investment Programs

Small Business Investment Company (SBIC)

SBA licenses and regulates SBICs, privately owned and managed investment funds. They make equity and loan investments in qualifying small firms using their own money as well as funds borrowed with an SBA guarantee. Find out more about SBICs to see if your company qualifies.

Small Business Innovation Research (SBIR) program

Small enterprises are encouraged to participate in federal research and development that have the potential to be commercialized under this initiative. Determine whether or not the SBIR competitive awards-based program is right for you.

Small Business Technology Transfer (STTR) program

This program provides money for government innovation research and development projects. Small businesses in regions like silicon valley that qualify for this program collaborate with nonprofit research organizations in the early and middle stages of their development. Check to see if the STTR program is right for your company.

Relevant Information On How Startups Finance Hypergrowth

- At a high rate of corporate growth, the CFO is caught off guard by the need to globalize and standardize finance operations (especially when you want to get ready for an IPO).

- Cloud-based SaaS are financially built in such a way that higher adoption is closely linked to increased growth.

- During the fundraising phase, it’s normal for finance teams to take on debt.

- In terms of spending, tech organizations should concentrate on two major areas: marketing (especially online marketing) and people (especially the hiring process)

- When it comes to SaaS, once you’ve launched a product, you need to focus on onboarding new customers (growing market share) and customer success (essentially keeping them happy).

- Series A startups are companies who have just started their business and have a customer base, proof of concept, and so on. Series B capital is often reserved for firms wanting to expand their production or sales.