No matter the industry, size, or growth stage of your business, it requires equipment to operate. Having the right equipment can assist you in scaling up your company or improve the way it operates by making processes cheaper, faster, or reducing waste. However, upgrading or purchasing the equipment your company needs can be a big expense. Equipment financing loan allows you to purchase the tools your business needs, without a major hit to your cash flow.

Equipment financing loan explained

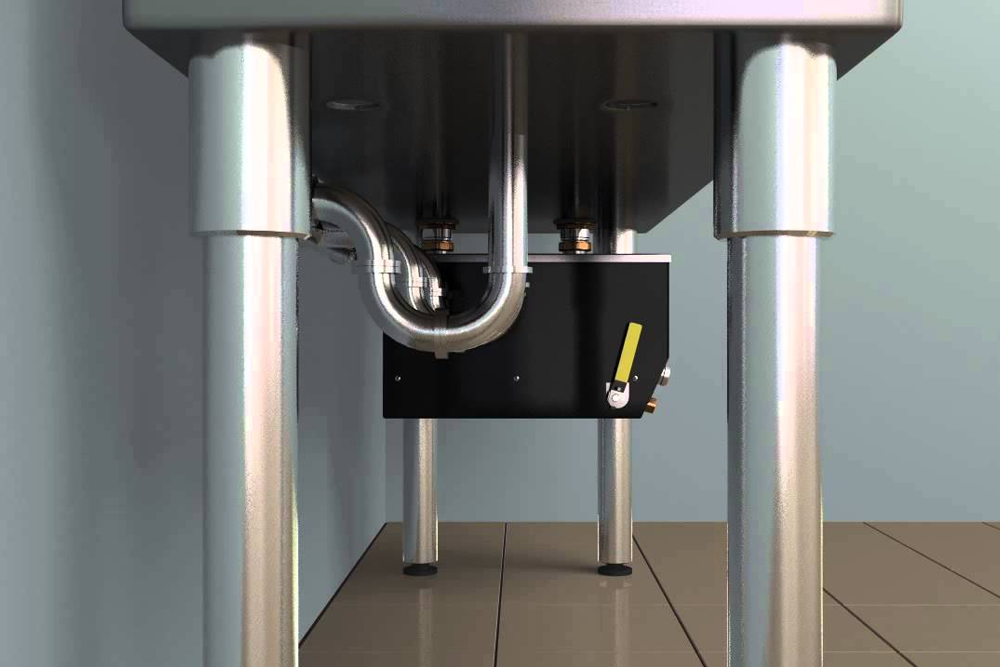

As the name implies, equipment financing loan is a specialized kind of business financing used to purchase equipment. What constitutes equipment varies by company, but can be thought of as anything physical that the company uses in its operations. This could include, for example, vehicles, computers, medical equipment, furniture, construction equipment, and other specialized machinery and tools. With an equipment financing loan, the equipment might itself be used as collateral. For new or small companies that do not have other assets to secure the loan, this built-in collateral is a major advantage. Also, after the debt has been repaid, the business owns the equipment outright.

Equipment financing loan covers a significant percentage and, in some cases, the equipment’s entire cost. Business owners who might not have much cash reserves can thus avoid raising large sums of money upfront before they can purchase the equipment they need. Even business owners who already have the capital to purchase might prefer to use equipment financing loans to free up funds to use elsewhere in the business.

What can equipment financing loans be used for?

Whereas the definition of equipment financing loan indicates that it is used for acquiring equipment, that is a fairly general explanation. Here are examples of how to use equipment funding:

- Trucking equipment loans – you can use these funding to expand your fleet of trucks

- Construction equipment financing – finance anything from heavy machinery to handheld power tools

- Restaurant equipment funding – deep freezers, mixers, food processors, ovens, food processors, etc

- High-tech companies – computers, software, air-con (to keep hardware from overheating

- Agriculture – plows, combines, irrigation systems, plows, tractors, etc.

This is only a drop in the sea when it comes to ways to use equipment financing loans – the list reaches as far as your imagination. If there is something you want (or need) to purchase for your business, chances are you can use an equipment financing loan to help you cover the costs.

Pros of equipment financing loans

To help you decide if an equipment financing loan is right for your company, we have compiled a list of the pros and cons of equipment financing loans in this section.

Receive money to lease, purchase, or repair equipment

Even if your company is well-established, chances are you do not have ample cash available to spend on equipment. Luckily, cash for equipment is exactly what these types of loans offer. Since business equipment financing loans allow you to borrow money specifically to pay for equipment, you do not have to wait until you have the cash-on-hand to make an important repair or purchase equipment that you already own. Having this money can improve your company’s bottom line; waiting to repair, purchase or lease equipment could severely harm your business’s annual revenue, mainly if the equipment is crucial to your operations. For example, if your restaurant’s oven breaks, you will need to replace or repair it as soon as possible.

Spread the Cost of Your Purchase

Cash flow is a constant concern for any business owner, and equipment purchases only complicate cash flow issues further. Nonetheless, since an equipment loan allows you to spread your cost, this type of loan assists you solve the cash flow problem presented by equipment purchases.

For instance, let us say you require to buy a large format printer for multiple business locations, and the total cost will be $100,000. With an equipment financing loan, you could put 10 percent down and pay an annual interest rate of six percent over five years. That indicates you would be paying $10,000 on day one and making monthly payments of about $1,700 over a five-year term. Without an equipment financing loan, you would need $100,000 in cash immediately to buy the equipment outright.

No need for extra collateral

To be eligible for a term loan, you could be required to provide collateral that you already own, such as vehicles or real estate. This typically is not the case with an equipment financing loan. Online and alternative lenders will often be satisfied with using the equipment you are buying as collateral for the loan. This can be very beneficial since this significantly lowers your downside risk.

Increase your company’s future sales

If you receive an equipment financing loan, it could improve your company’s overall productivity. For instance, presuming you own a manufacturing company, having extra machinery could help you complete orders faster. You can even take on additional customers, which would boost your bottom line. By receiving an equipment financing loan, you will be investing in your company and might even be able to earn more money in the long run!

Cons of equipment financing loans

Equipment financing loan has its own disadvantages. Here we dig in the cons of equipment financing.

Usage is restricted to equipment.

Just as the name implies, equipment financing loans can only be used for equipment. That indicates you will not be able to use the proceeds from an equipment loan to fund rent, payroll expenses, or anything else. For instance, if your business needs financing for construction equipment but also wants to utilize the funds for payroll, this is not the right type of loan for you in this scenario. Other kinds of additional working capital, such as lines of credit, merchant cash advance, or a credit card, give you the flexibility to use the financing as you see fit. Of course, this is not a very serious shortcoming if the only thing you need the cash for is to purchase equipment.

Higher rates than traditional loans

Equipment financing loans generally offer favorable interest rates, as low as five percent, following US News. Nonetheless, if you have an excellent business credit history, you will likely be able to obtain a lower interest rate by taking out a traditional loan. Before you apply to any type of financing, we suggest you check your credit score. That way, if you have challenged credit, you can correct it before applying.

Note that some traditional lenders can be slower to offer a loan amount (up to 30 to 90 days) and will need more documentation. Moreover, many lenders have time in the business requirement, indicating you might have to wait until you have been operational for a certain length of time. Thus, if your equipment needs are pressing, you might not be able to wait for a traditional lender to approve your application.

You own the equipment.25

Fully owning business equipment could be an advantage or a disadvantage, based on how you look at it. When you get a small business loan for equipment, you are borrowing money to buy and own equipment. An alternative to this is equipment leasing. With equipment leasing, you make monthly payments to use the equipment, and then return it once the lease is over. For equipment that might become obsolete or depreciate relatively faster, owning rather than leasing could be costly for your business. Nonetheless, for long term equipment, owning is usually more affordable. William Sutton, the president and CEO of the Equipment Leasing and Finance Associations, recommends leasing if you need the equipment for less than 36 months.

The Difference Between Equipment financing loan and equipment leasing

The terms “equipment financing loan” and “equipment leasing” are sometimes used interchangeably; however, be aware they are not exactly the same things. Equipment financing loan enables you to own the equipment at the end of the term, but with equipment leasing, you make monthly payments for the ability to utilize the equipment for a set amount of time. This makes equipment leasing a more cost-effective option for the equipment you only have a temporary need for or would become out-dated by the time it is paid off. Equipment financing is better suited for equipment that is vital to your long-term business operations.

Conclusion: Determine if an equipment financing loan is right for your business

Unlike many other kinds of business financing, equipment financing loans are meant for a particular purpose. Whereas that prevents these loans from being versatile, it also indicates that — for the right person —equipment financing loans can be extremely effective. To help yourself make the best decision, take the time to research, understand your needs, and evaluate the type of equipment your business requires. That way, you will have all the necessary information you require to make your business’s best decision.