When the need to borrow money for business purposes comes up, there are many choices to choose from, including borrowing from friends and family, a traditional loan from a bank, and a cash advance on a credit card. There are two kinds of business loans to get from the bank: unsecured and secured. If you need financing for your new startup, you possibly have questions about secured versus unsecured business loans. Every type of loan has its requirements, as well as pros and cons. When you apply for a loan, it is essential to know the key difference between the two. You need to know which loan fits your business purpose best. Here are explanations of both unsecured and secured business loans. Ensure you go with the ones that fit your needs best.

What is a secured business loan?

A secured business loan is different from an unsecured business loan since you need to provide some type of collateral to the lender if you default on your payments for the loan. Typically, collateral is something that you can pledge as a security for the repayment of a loan. Some collateral examples include investments, a car, a home, or other personal or business assets that can be liquidated.

Since the loan is secured, interest rates are often lower on secured business loans. They are also easier to get since they pose a smaller risk for the bank. If you apply for a secured loan, ensure the assets that you put up as collateral are something that you are inclined to lose. There is always a chance that you might default, and you will lose whatever you put up as collateral. Also, ensure that you get an accurate estimate of your collateral’s value before speaking with a lender.

Lenders often provide lower values to collateral since they have to liquidate the collateral very fast. To do so, they will sell the collateral at extremely low prices. Thus, if you have a more current assessment estimate of your collateral, you can more easily persuade your lender that your product has value.

What is an example of a secured business loan?

Some examples of secured business loans include:

- Home equity line of credit: You can secure this loan with your home

- Auto loans: These loans are useful when making a major vehicle purchase, and are secured with the vehicle.

- Construction loans: These are loans to assist you in building on land that your own, and are secured with the property

- Mortgages: These loans for a property are secured with the property itself

What is an unsecured business loan?

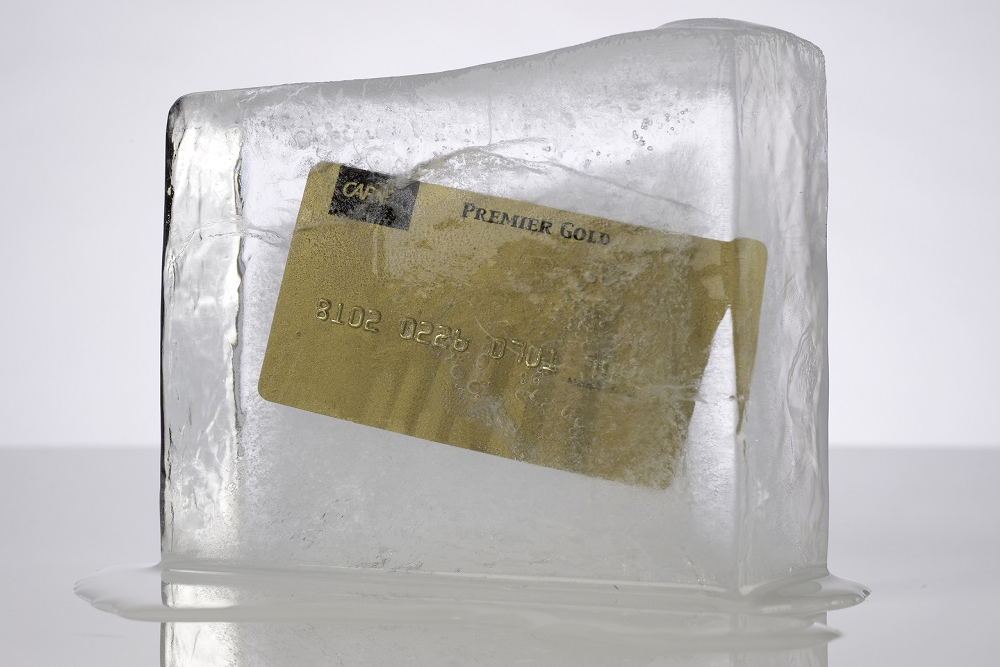

Unsecured loans are given without any type of collateral from the buyer. They are made based on your credit ranking and other methods to determine your creditworthiness. Since these risks are unsecured, and there is no collateral, there is a higher risk for the lender. As a result, they often have higher interest rates than secured loans, and they are also difficult to obtain compared to secured loans.

Bear in mind that sometimes the interest rates on unsecured business loans can be higher than the interest rates on your credit card. Usually, the interest rate for this kind of loan is fixed; however, it is possible to have an unsecured business loan with a variable interest rate. In any case, the unsecured business loan will always be higher than the secured business loan.

Generally, the term of an unsecured business loan is shorter than that of a secured business loan. When there is no collateral to lower the bank’s risk, the bank wants the money to be paid as soon as possible. This is to reduce the risk of the bank. It is also the reason why there are more secured business loans given out than unsecured loans. Secured business loans offer less risk for financial institutions.

Besides, most lenders require that you have a great credit rating and that you have been in business for at least two years. Generally, the unsecured business loan works best for established business borrowers with an excellent credit history. The loans are not suitable for startup companies or people with no so great credit ratings.

Examples of unsecured loans

- Signature loans: If you have a good relationship with a bank, you might get a signature loan. This is an unsecured loan that depends on a good-faith assessment of the borrower’s character and promises to repay the money.

- Credit cards: These are the most common examples of unsecured loan instruments. Anytime you pay for something with a credit card backed by a financial body, that institution provides you an unsecured loan on the spot.

What is collateral?

Collateral is something guaranteed as security for repayment of a loan, to be forfeited in the event of a default. Collateral might take the form of personal or business assets, real property, or any other big product that you will purchase with the loan if you are approved.

Examples of collateral for secured business loans

- Financial property like bonds and stocks

- Rare collections, watches, jewelry, or other valuable personal items

- Large and valuable personal property items such as cars

- Land, offices, houses and other real estates

- Large and valuable personal property such as cars

- Cash in the bank (You can provide cash as collateral to borrow more money

- Any asset that can be changed into cash to pay off the loan

What are the pros and cons of secured business loans?

Secured business loans usually offer these benefits:

- Longer repayment terms

- Higher borrowing limits

- Lower interest rates

There are also some downsides of secured business loans

- Longer repayment terms might be regarded as a pro or a con, based on your point of view, longer repayment terms can mean you will be in debt for a longer period.

- If you provide collateral, you risk losing the asset to the lender if you cannot pay back the loan

- You have to provide some personal or business assets to secure the loan

In essence, these advantages are what you are buying with your collateral. By putting your personal or business assets on the line, you can usually secure better terms from your lender. In this sense, a secured business loan offers each side something it values. The lender assures that there is a valuable asset ensuring repayment, which then enables the lender to feel secure enough to offer a more favorable deal.

It is also worth noting the tax benefits of secured business loans. If you have a secured loan, it is possible to write-off interest linked to the loan. This would be true if your primary home secures the loan. However, you are then putting your home at risk if you can not make payments on the loan. With an unsecured business loan, you cannot write-off the interest since it is not collateralized. This will prevent any of your assets from being at risk.

Pro and cons of unsecured business loans

- In contrast to a secured business loan, here are some benefits of unsecured business loans:

- It is often simpler to borrow small amounts of money with unsecured loans

- You will not risk losing your collateral since you are not providing any

- You do not need to provide collateral

Here is a summary of the downsides of unsecured loans:

- Shorter repayment terms

- Smaller borrowing amounts

- Higher interest rates

- Personal liability

The major downside of unsecured loans is a liability. You are not providing collateral; however, you can be personally accountable for the loan. If you are not able to pay back the loan, your lender can sue you and come after your assets anyway. If you do not win such a lawsuit, you might face the consequences of garnished wages or loss of other personal or business property.

As discussed above, unsecured business loans often come with shorter repayment terms, smaller loan amounts, and higher interest rates. While all of these can be big drawbacks, they might not be. The type of loan you choose will be based on your situation, the duration you need to pay back the loan, and the amount you want to borrow.

Secured versus unsecured business loans: Which is right for you?

What kind of business loan is best for you depends mainly on the circumstances you are in and your goals. Bear in mind that a secured loan usually is easier to get, since it is a safer venture for the lender. This is largely true if you have a poor credit history or no credit history. If that is the situation, lenders justifiably want some type of reassurance that you are not gambling with their funds (which, when you get right down to it, is other people’s money that you are investing ideally in responsible loans).

A secured business loan will tend to come with better terms, like higher borrowing limits, lower interest rates, and, as discussed above, longer repayment schedules. Then again, maybe you do not have or want to offer collateral. Perhaps you are more concerned with just weathering the storm, and you are not worried about paying a higher interest rate. Or perhaps you plan to pay back the money immediately, in which case, you are not concerned about interest or a lengthy payment plan. And presuming you do not need a small fortune, the higher borrowing limit may not be a feature that you care about. In these circumstances, you might prefer an unsecured loan.